Scarsdale Agrees to Be Plaintiffs in Legal Challenge to IRS Rules Regarding Deductibility of Charitable Gift Reserves

- Details

- Written by Joanne Wallenstein

- Hits: 7377

State Assmeblywoman and Scarsdale resident Amy PaulinScarsdale made history on Tuesday night February 13, 2019 when the Village signed on as a plaintiff in a lawsuit to challenge IRS rules regarding the deductibility of state and local taxes in charitable gift reserves.Trustees voted yes to join a lawsuit that, if successful, could help states beleaguered by the new SALT provisions to recoup most of their lost tax revenues.

State Assmeblywoman and Scarsdale resident Amy PaulinScarsdale made history on Tuesday night February 13, 2019 when the Village signed on as a plaintiff in a lawsuit to challenge IRS rules regarding the deductibility of state and local taxes in charitable gift reserves.Trustees voted yes to join a lawsuit that, if successful, could help states beleaguered by the new SALT provisions to recoup most of their lost tax revenues.

State Assemblywoman Amy Paulin is leading the charge to contest these rules which deny residents the right to pay into a charitable gift reserve and deduct local taxes from their federal tax returns. As Paulin explained at the meeting, “The US Congress decided to limit SALT deduction last December. At the time group of tax professors from around the country wrote a white paper about what they believed could be done if SALT was adopted. One of the options was establishing a charitable fund and we folded that proposal into the state budget, along with New Jersey and Connecticut. Dan Hemel, an SHS grad now at the University of Chicago was one of the authors of that white paper.”

She continued, “Scarsdale established a charitable fund along with Rye and Rye Brook. However the IRS came out with rules that created a chilling effect. Assemblyman David Buchwald and I brought a group of local leaders together and wrote comments on these IRS rules and regulations. We are still awaiting the final regulations. When they come out, we want to be in a position to challenge them. The best plaintiffs are towns that have already formed charitable trusts like Scarsdale and Rye. The state stands to lose $2.3 billion in local taxes. The potential harm to our communities is great.”

Why Scarsdale? The resolution says, “The implementation of these regulations as drafted would harm Scarsdale residents who have already made donations or who might seek to make donations in the future to the charitable gift reserve fund, and would directly harm the ability of the charitable gift reserve fund in its capital raising efforts as envisioned under New York State law.”

Paulin said, “Scarsdale will be taking an action to protect our residents. The liability to the village is nothing. We have formed a 501C4 to assume the liability.” She explained that tax attorneys from Baker and McKenzie of Chicago, Illinois would draft the papers pro bono and no work by the Village would be required.

The resolution before the board was to execute an engagement letter to provide no cost legal services in connection with participation as a plaintiff in challenging internal revenue service charitable gift reserve fund regulations.

Not everyone agreed that this was a good move for Scarsdale. During public comments Bob Berg discussed his concerns that the Village would be open to liability and ridicule and that meetings about the suit were held behind closed doors. He said, “Amy has convinced the BOT that joining this lawsuit is wise. … The discussions were not held publicly…. This puts the good name of Scarsdale in jeopardy. Can you imagine the scorn we will face? The pundits will drag our good name through the mud. She says the 501c4 will pay the legal fees of this litigation. Baker and McKenzie is one of the world’s largest law firms in the country. This will cost more than $1,000,000… The 501 c4 is headed in Scarsdale in Amy’s house. It’s a dark money political action committee. The odor of rotting fish is getting stronger. The red flags are wild – they mean danger.”

Anne Hintermeister of Chase Road agreed. She said, “What happens if we can’t cover the law firms fees? We need more information on this. Who is going to direct the litigation? Does the village have standing to challenge tax regulations?”

Bob Selvaggio of Rochambeau Road argued for a legislative solution and questioned the logic of deductible charitable funds. He said, “The only way to restore SALT deduction is to convince our legislators. The government that touches us most is our municipal government. Scarsdale should have first dibs on our taxes, followed by the state, and then the country. Few of us ask much of the federal government. President Trump should tighten his own belt so we can pursue our own happiness….Few of our state dollars are returned to our schools. Our tax payments are not charitable contributions. This only subjects us to ridicule. They are other avenues to pursue. Empty nesters could argue that there is no quid pro quo – and they should be able to deduct school taxes as charitable deductions. We need to convince senate house and legislators that we need our local deductions.”

Paulin responded to these objections. To Selvaggio’s call to overturn SALT, she said, “Good luck convincing the federal government. Though I hope one day it will get overturned I am not holding my breath. Once you give the money away its hard to get it back. It is going to be hard to reverse SALT. The President rejected Governor Cuomo’s effort to reverse SALT. The Republican Party is not in favor of reversing SALT. I believe the charitable deductions are the best way to mitigate the effects.”

She also explained that there was precedent, saying “There are already active programs across states for parochial schools that allow tax deductions. This is historical – and these arguments will be made. The IRS ruled that all of the tax programs – including all of the existing ones in many states -- are not valid either! It affected so many people – thousands of children. They pleaded with the IRS to reverse their position. If we’re not in the lawsuit, there could be a carve out that doesn’t affect us.”

“So I applaud the Village for being involved – I think this is the right thing to do – we are going to work together to make this the best effort we can going forward.”

Before the voting, Trustees shared their thoughts:

Trustee Justin Arest said, “This is an extension of acts already taken by this government …We can and should do this – we created a charitable fund. This is not a scheme that we are creating on our own. …This is not our only option – but this is our best option now. These tax changes were having a negative effect on our homeowners. It is not about partisan politics – it is what I can do as a trustee to fight for Scarsdale residents.” He voted Aye.

Trustee Matt Callaghan was the sole objector, saying “This represents an unacceptable risk. What happens if the funding stops? Who is going to monitor the activity of this fund and set timelines and milestones? Not many people in Westchester are involved in this. Consider the current political atmosphere in the nation. I vote No – “

Trustee Lena Crandall thanked Palin for the “great effort to protect local residents.” She voted yes.

Trustee Carl Finger said, “The agreement is clear – we have nothing to do with the funding. We will receive appropriate reports. I vote Aye.”

Trustee Seth Ross also thanked Paulin for her leadership and said, “We have an opportunity and responsibility to vindicate those rights. No funds are to be committed. I vote Aye.”

Trustee Jane Veron assured the public that there would be no liability to the village. She said, “We had the opportunity to speak with counsel. And we have no financial risk. We didn’t take decision lightly. We believe it is our duty to protect our residents and I vote Aye.”

Casting the last vote in favor of the resolution, Mayor Dan Hochvert said, “It is okay to take risk when we have so much to gain. Most will not see anything but an effort. I vote aye.”

The resolution passed by a vote of 6-1.

A Lively Week of Paddle at Fox Meadow Tennis Club

- Details

- Written by Joanne Wallenstein

- Hits: 6252

The balls were flying at Fox Meadow Tennis Club this week where two annual events brought out paddle enthusiasts for great competition, food and fun.

The balls were flying at Fox Meadow Tennis Club this week where two annual events brought out paddle enthusiasts for great competition, food and fun.

On Wednesday February 6, the theme of the member guest tournament was “Rumble in the Jungle” and beasts and their guests were instructed to wear animals prints, furs and skins. The clubhouse was awash in monkeys and wild animals, monkeys howled from the speakers and members were greeted by a life-sized gorilla. Each player was given a fur animal print neck roll and the competition was fierce. Congrats to Nanette Koryn and Robin Aisenman for a top-flight event, and to tournament winners Robin Aisenman and Kathy McMahon, and consolation draw winners Gretchen Reuter and Jani Mason.

On Wednesday February 6, the theme of the member guest tournament was “Rumble in the Jungle” and beasts and their guests were instructed to wear animals prints, furs and skins. The clubhouse was awash in monkeys and wild animals, monkeys howled from the speakers and members were greeted by a life-sized gorilla. Each player was given a fur animal print neck roll and the competition was fierce. Congrats to Nanette Koryn and Robin Aisenman for a top-flight event, and to tournament winners Robin Aisenman and Kathy McMahon, and consolation draw winners Gretchen Reuter and Jani Mason.

On Saturday February 2 the club hosted “The Vixen,” their version of an adult color war where 24 players were broken into teams of six and competed to win the most games. Colorful drinks, cookies, balloons and hats made for a rainbow of fun. The event was presented by Gail Behar, Tammy Fine, Jill Fisher and Diane Loft. Congrats to gold team winners Gail Behar, Diane Loft, Wendie Kroll, Ping Klein, Gretchen Reuter and Bella Dalton.

LWVS Asks Board of Education to Develop a Policy on Gifts and Donor Recognition

- Details

- Written by Joanne Wallenstein

- Hits: 3859

This statement was read and submitted to the Scarsdale Board of Education at the January 28 meeting by the LWVS:

This statement was read and submitted to the Scarsdale Board of Education at the January 28 meeting by the LWVS:

Hello, my name is Linda Doucette-Ashman, Brite Avenue. Tonight I am speaking to you, the Board of Education, on behalf of the Board of the League of Women Voters Scarsdale.

This statement is about the District’s gift policy and associated issues including donor recognition and naming rights.

I want to begin by clearly saying that our statement is about process and does not go to the merits of any issues that might arise during any discussion or consideration of any policy related to gifts or donor recognition.

On behalf of my Board, I wish to acknowledge and thank those individuals and entities, including but not limited to, the Education Foundation, Maroon and White, Friends of Music and Art and all of the PTAs, who give so generously of their time and money to help support our children and our school community.

The League acknowledges that the Board of Education (“Board”) and the School District Administration are currently exploring the possibility of installing lights around Butler Field, based upon a presentation by Director of Physical Education, Health and Athletics, Ray Pappalardi, on Monday, January 14, 2019 at the Board’s Special Meeting immediately preceding its Business Meeting. It is the League’s understanding that no final decisions have been made about whether or not the lights will be purchased or how the project will be funded. The League observed, during the presentation, Mr. Pappalardi mention that private donations would be made to the School District to fund a large portion, if not all, of the cost for this project. The current estimated cost is $881,000. Mr. Pappalardi also discussed the possibility of donor recognition plaques for those members of the community who donate money for this Butler Field light project.

For the second time in less than a year, the Board is faced with a situation where updated gift and donor recognition policies are needed. The League has repeatedly recommended that the Board proactively develop gift policies through a thoughtful, methodical, public process that actively engages community input to ensure the resulting policy accurately reflects Scarsdale community values for our public schools. The League continues to recommend that the Board actively engage the community and (1) establish a separate policy setting out the Board’s relationship with the Education Foundation and the gifts that it provides to the School District, and (2) review any existing policies that pertain to these issues, including Policy 1800 (Gift) and Policy 1222 (Relations with Booster Organizations) as well as establish policies that address donor recognition and naming rights.

In 2013, 2014 and 2018, the League issued multiple statements recommending that the Board develop and adopt “a new policy, specific to gifts given by the Education Foundation to the District, in light of the new and unique relationship between the BOE and the Education Foundation,” as well as “the size and nature of past and contemplated gifts from the Education Foundation to the District.” In 2014, the League further suggested that the Board also “develop a policy regarding the recognition of gifts initiated by donors, including naming rights.” While certain League suggestions were incorporated into the Board’s revisions to its Gift Policy (1800) in 2014, the Board has yet to adopt these two key League recommendations. In 2018, the League reasserted its recommendations from 2013 and 2014 and recommended that the Board develop policies, with community input, to set out its relationship with the Education Foundation and to clarify its position regarding donor recognition for gifts and naming rights. Please note that copies of our previous statements referenced herein are attached.

During the spring of 2018, the League observed the Board consider and eventually approve the Education Foundation’s two donor recognition plaques to recognize donors who contributed to the Education Foundation’s Capital Campaign for projects, including the High School Learning commons and Design Lab. At that time and prior to the Board approval, the League recommended that the Board develop both a separate gift policy specific to the Education Foundation and a donor recognition policy that would appropriately incorporate and reflect Scarsdale community values. However, the Board concluded that the use of a Memorandum of Understanding in combination with the District’s existing Gift Policy 1800 provided sufficient authority for the Board to approve and accept the donations and plaques. The Board also decided that there was no need either to engage the community or undertake a study of Policy 1800 or the issues raised by the donations of the Education Foundation, including donor recognition or naming rights. To date, the Board has not had any further public discussions about the Gift Policy, the policy pertaining to relations with Booster Organizations, donor recognition or any of the related recommendations provided by the League.

The League observed that on January 14, 2019, the Board discussed and approved Mr. Pappalardi’s request to collect community feedback on the possibility of the installation of lights around the new and improved Butler Field. As part of that discussion, Mr. Pappalardi indicated that Maroon and White would contribute approximately $200,000 and the balance of the project cost would be funded by private donations as well. Mr. Pappalardi mentioned a suggestion to have donor plaques installed in the project, an idea presented was including a plaque on each lamp post.

Since the Board is facing the possibility of large donations and donor recognition requests again, the League will take this opportunity to reaffirm its previous statements and recommendations on these issues.

Regarding the Education Foundation, the League asserts, as we did in our comments of April 16, 2018, that there is gap to be filled with respect to the definition of the Board’s relationship with the Education Foundation. The League suggests that the Board is at an opportune time to develop a policy to establish and clarify that relationship, just as the Board has done with respect to other booster organizations. Again, the League reasserts that if the Board continues its process by replacing one MOU with another, without first establishing policy to guide what principles, priorities and values will shape the next agreement between the Board and the Education Foundation, it will not be incorporating necessary public input to ensure consistency with Scarsdale community values and priorities. In addition, the League reasserts that timing is appropriate for the Board to ensure its understanding of community values by engaging the broader community in discussion of the full range of issues that arise with such large donations, donor recognition and naming rights.

Regarding donor recognition, the League believes that the Board’s one-time approval of donor recognition signage for the Education Foundation gifts and donor recognition plaques to the District for the High School Design Lab and Fitness Center, which the Board stated was not intended to set precedent, highlighted issues that existing Board policy has yet to address. At that time, the Board declined to address them. As we have previously stated, we are still of the opinion that members of the Board and District Administration had begun to discuss and recognize both the absence of, and the need for, a policy regarding recognition of donors. Furthermore, we believe that, without an appropriate policy in place moving forward, the Board’s one-time recognition of certain donors to the Education Foundation’s gift to the District, serves as precedent that potentially governs future Board actions with respect to donor recognition for other projects.

The League further reasserts that:

● As elected officials, Board members are accountable to the public and have a responsibility to engage in public deliberation and public discussion, and to give the public an opportunity to observe the Board’s decision-making process and to weigh in on its deliberations;

● The Board has a responsibility to provide ample public notice of, and public opportunity for comment on Board discussions and actions regarding the Education Foundation, and donor recognition, including separately scheduled Board meetings for Board discussion and Board action; and

● The Board has the responsibility to develop a donor recognition policy that can be applied with consistency, fairness and transparency for both the donors and the community.

Recommendations:

1. We urge the Board to develop a policy regarding the recognition of donors of gifts to the District, including naming rights. We further urge the Board to solicit public input and schedule opportunities for public comment to ensure that resulting policy reflects community values. In addition to obtaining a sense of community values, this effort will provide the Board with opportunities to identify and address specific issues associated with donor recognition in a deliberate and methodical manner and thereby allow for the creation of a policy that will enable consistent application going forward.

2. In light of the Board’s unique relationship with the Education Foundation, as well as the size and nature of past and contemplated gifts from the Education Foundation to the District, we continue to urge the Board to reconsider our previous recommendations to develop and adopt a separate policy regarding its relationship with the Education Foundation.

3. We also ask that the Board review any and all existing policies that may impact these issues, including, but not limited to, Policy 1800 (Gifts) and Policy 1222 (Relations with Booster Organizations).

Thank you for your consideration.

LEAGUE OF WOMEN VOTERS OF SCARSDALE

BOARD OF DIRECTORS

Linda Doucette-Ashman and Janice Starr, Co-Presidents

SignUp for Food Scrap Recycling and Receive a Free Cookie at Cooked & Co.

- Details

- Written by Joanne Wallenstein

- Hits: 3405

Scarsdale’s #ZeroWasteAllLove Campaign calls on residents to recycle food scraps in the month of February, connecting compost, cupid and surprisingly, cookies.

Scarsdale’s #ZeroWasteAllLove Campaign calls on residents to recycle food scraps in the month of February, connecting compost, cupid and surprisingly, cookies.

What do cookies have in common with composting? Well, quite a lot if you stop by Cooked & Co. Monday through Wednesday, February 11th, 12th and 13th from 11 am – 2 pm, where residents can register for the Scarsdale Food Scrap Recycling Program and receive a Cooked & Co’s signature “compost cookie” – an everything-but-the-kitchen-sink sweet and salty, chewy and gooey treat.

During the month of February, the Scarsdale Conservation Advisory Council is wooing residents to take on zero waste practices and join the 1,000+ Scarsdale homes that participate in Scarsdale’s Food Scraps Recycling program. Thanks to the Village’s new curbside pickup service, compostable food scraps are no longer destined for the garbage!

Residents can also register for the Scarsdale Food Scrap Recycling Program and curbside pickup service online here or by sending an email to [email protected].

Cupid’s message is clear: #ZeroWasteAllLove.

Cooked & Co. is located at 128 Garth Road, Scarsdale, NY.

For more information about the Food Scrap Recycling program email [email protected].

Where Your Village Taxes Go

- Details

- Written by Joanne Wallenstein

- Hits: 4738

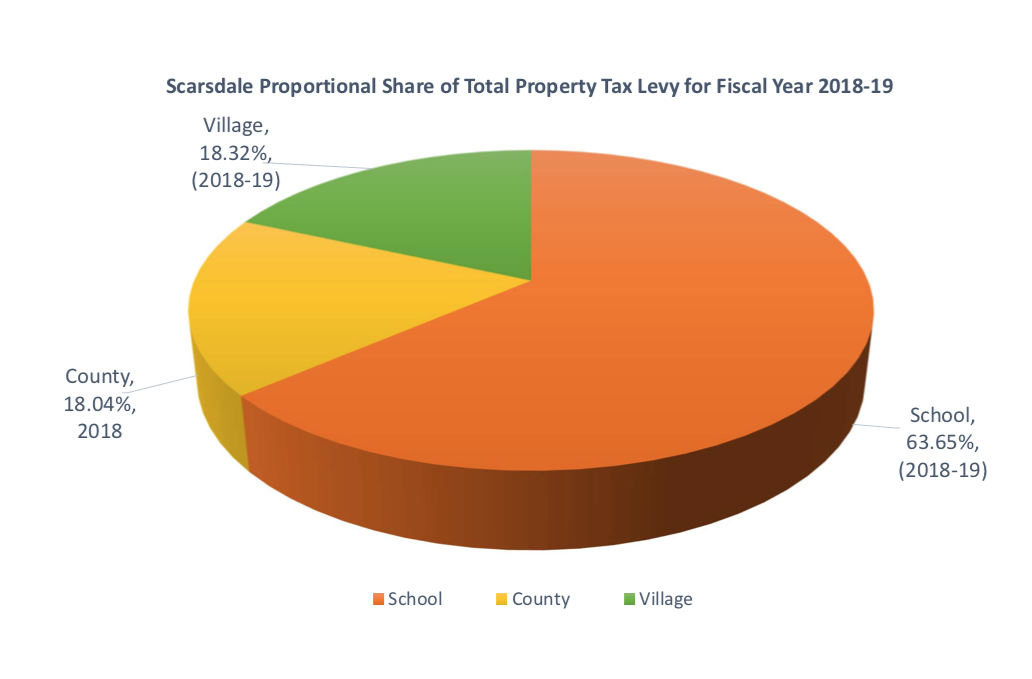

Though the portion of your real estate taxes that goes to Scarsdale Village only accounts for 18.3% of the total bill, the services they fund are perhaps the most visible manifestation of your payment. Many residents are not clear on which department is providing which service and how their tax payments are being spent. In an effort to enlighten the public on just what the Village does, the Scarsdale Forum and League of Women Voters presented a session called “Where Your Village Property Tax Dollars Go: An Overview” at Village Hall on Thursday January 10, 2019. You can watch the presentation on video here:

Though the portion of your real estate taxes that goes to Scarsdale Village only accounts for 18.3% of the total bill, the services they fund are perhaps the most visible manifestation of your payment. Many residents are not clear on which department is providing which service and how their tax payments are being spent. In an effort to enlighten the public on just what the Village does, the Scarsdale Forum and League of Women Voters presented a session called “Where Your Village Property Tax Dollars Go: An Overview” at Village Hall on Thursday January 10, 2019. You can watch the presentation on video here:

The program was well attended and included presentations from Village Manager Steve Pappalardo, Village Treasurer Mary Lou McClure, Benny Salanitro head of the Department of Public Works, Police Chief Andrew Matturro and Fire Chief Jim Seymour. They explained how the annual $56.5 million in Village taxes are spent.

Here are just a few facts that may surprise you:

Scarsdale has 91 miles of roadways – 78 miles are owned by the Village and the rest by the county and the state.

5 miles of roads were repaved and 8,000 linear feet of curbing were installed in 2018

The Department of Public Works collected 4,100 tons of fall leaves in 2018.

The Sanitation Division collected approximately 6,700 tons of solid waste, 8,000 tons of organics, 650 tons of co-mingled recyclables, 1,800 tons of newspapers, 14.8 tons of textiles in 2018.

In 2018 the Scarsdale Fire Department responded to 1,778 calls, an increase of 343 over 2017. Why? Chief Seymour says, “My best conclusion was that the automatic aid agreement added roughly 24 responses and there were two significant storms (3/2 & 9/25) in which handed us 50 responses for each. Lastly, through social media and word of mouth, we have really increased our efforts to educate our residents to call us when they need us.”

And Police Chief Andrew Matturo reported that the average response time for police for priority calls in 2018 was 4.05 minutes and for all calls was 4.40 minutes.

What is the cost of these services per household?

The average household pays $832 a year for roads, sanitation and facilities maintenance.

The average household pays $751 for police protection.

The average household pays $629 a year for fire protection.

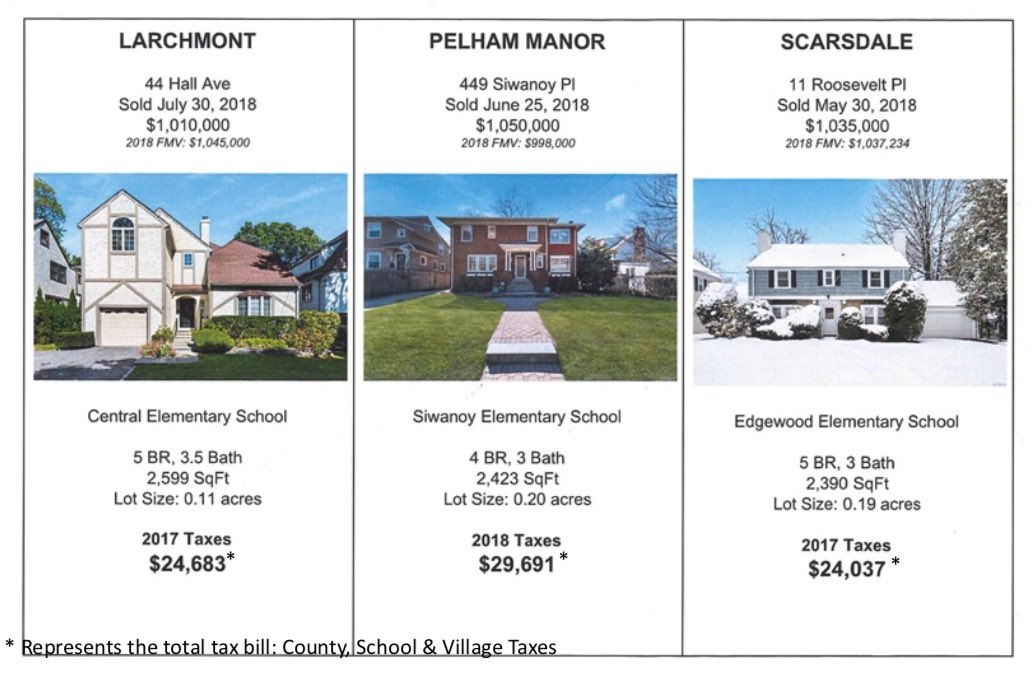

Another question often asked, is how do our local taxes compare to those paid by residents of neighboring municipalities. It turns out that our rates are pretty favorable.

Village Treasures Mary Lou McClure presented the following bill that compares property taxes in Scarsdale against taxes in Larchmont and Pelham Manor for homes of a similar assessed value:

And how does Moody’s rate Scarsdale’s debt? McClure reported that Scarsdale has an Aaa rating which “reflects the village’s sound financial position with healthy reserves and history of stable operations, affluent and sizeable tax base favorably located near New York City and manageable fixed costs. The rating also reflects moderate pension and OPEB liabilities.”

Following the presentation, the audience was given the chance to ask a few questions. The first asked if the Village of Scarsdale has considered consolidating services with other municipalities. Village Pappalardo replied that “yes” the Village had considered this many times and is doing what it can to share services with neighboring municipalities without doing a wholesale consolidation. Fire Chief Seymour noted mutual aid agreements with other fire departments to respond to fires in Eastchester and Greenburgh and to have their forces back ours as well.

Another asked if the Recreation Department was self supporting. Village Manager Pappalardo said that the Rec Department puts on 150 programs and 65% of their expenses are covered for fees collected by users. However, the cost to manage the department and maintain the facilities are covered by taxes rather than fees.

To a question about the development of the Freightway site, Pappalardo said, “We have seven responses from developers. The Board is discussing next steps – including drafting an RFP. There is a public comments session on January 22 at 6:30 and you can see all the documents online under “planning.”

To a question about upgrading Village Hall, Pappalardo said, “There is nothing in the budget now, though it will have to be addressed sometime. We need $1.5 million just to upgrade Rutherford Hall. The whole building needs a lot of work.”

Dara Gruenberg who spearheaded the event said, "I am thrilled that the LWVS and Forum collaborated which is unprecedented. The feedback I have received from many who attended and aren’t involved in the Village was that it was very informative and clear. We marketed it to the real estate agencies and a lot of brokers came. I think there were 60 people there. So overall a success! Huge thanks to the LWVS, the Forum, Village Staff, and the committee that worked so hard to put this together."

Learn more about where your taxes go here: