Scarsdale Board Approves New Code Regulating Disitributed Antenna Systems

- Details

- Written by Joanne Wallenstein

- Hits: 5189

The Scarsdale Board of Trustees covered lots of ground at their 2-11 meeting, passing a much-discussed change to village code regulating the installation of distributed antenna systems in the village right of way and hearing public comments on the Homestead Tax Option which threatens to triple taxes for owners of 42 Christie Place Condominiums.

The Scarsdale Board of Trustees covered lots of ground at their 2-11 meeting, passing a much-discussed change to village code regulating the installation of distributed antenna systems in the village right of way and hearing public comments on the Homestead Tax Option which threatens to triple taxes for owners of 42 Christie Place Condominiums.

At the opening of the meeting Mayor Bob Steves called for a moment of silence for Eda Newhouse who passed away on Monday February 10 at the age of 88. He noted her "high energy and commitment to the Scarsdale community" and said her legacy would live on and on.

The Board held a public hearing on the Wireless Facilities Communications code. Provisions in the new code regulate the size, height, placement, distance between nodes and appearance of the antennas to minimize their visual impact on the environment. They also specify that landscaping with trees, shrubs be used to shield the site lines.

Among the new provisions for DAS are:

- The proposed facility must be the least intrusive means of closing a significant gap in wireless service.

- The structure and antenna shall not exceed 120 feet in height

- New support structures shall be monopoles

- DAS will be sited to have minimum adverse visual impact

- The appearance of antennas shall be harmonious with its surroundings in terms of color, texture and architectural style.

The new code also outlines a rigorous application and renewal processes.

Though this new code was debated for years, during the hearing there were no public comments and the resolution passed. You can view the new code here:

Tax Cap: The Board passed a resolution to authorize a tax levy in excess of the New York State Tax Cap.

Homestead Act: Debate continued on the adoption of the Homestead Tax Option, following discussions at meetings of the Scarsdale Forum on Thursday February 6 and a meeting of the Scarsdale Trustees on Monday February 10.

In the public comments portion of the meeting, William Sulzer, an attorney from Bronxville who has been retained by the Christie Place homeowners to represent them, posed several questions and was asked to contact Village Manager Al Gatta to review them.

Robert Berg, Chair of the Scarsdale Forum's Assessment Revaluation Committee spoke at length about the Forum's recommendation to adopt Homestead which was approved by the Forum on February 6 by a vote of 11 for to 8 against. He said, "In order to be fair to all, the act must be adopted even though a small number will see their taxes soar.... The decision to adopt the Homestead Tax Act is binary; you either adopt it or your don't... There is no practical way to phase it in over time or mitigate the impact on Christie Place owners who may see their taxes rise by 200 – 300%."

Berg continued, "The average condo owner, with a market value of $1.3 mm, paid about $10,000 in property taxes in 2013. A house valued at $1.3 mm paid about $32,000 in 2013. The condo is taxed as if it were valued at $413,000. The total value of the condominiums is $55 million and they were taxed as if they were valued at $17.5 million and enjoyed a $928,000 property tax break in 2013. The nearly $1 million break is borne by every other homeowner in Scarsdale. How can that possibly be fair?"

He concluded by saying, "You have the ability to cure that inequity now or let it persist indefinitely. If you fail to do so, you will deprive the school board of making that decision as to the school taxes."

Stuart Royal, a homeowner and member of the Board of Directors of Christie Place spoke against Homestead. He pointed out that only 19 members voted at the Forum. He also questioned the valuation of the units used by the Village Assessor's office saying that these values were highly inflated and did not reflect the purchase prices of the units. He said, "We seem to be the scapegoats. We are 42 people stacked on top of each other."

Condo owner Daniel Girardi said "Homestead is about inequities between commercial and residential properties adopted by communities with an industrial base to prevent residential property owners from bearing an unreasonable tax burden. Bronxville and Mamaroneck both rejected it because of its adverse affect on condo owners. Scarsdale is unique because it has one condo property. This would triple our taxes and save $150 for everyone else. It does not seem to be a fair and equitable distribution."

Bob Harrison urged the Board to pass Homestead for "fairness in the community." He told that condo owners that if they have a tax grievance they could file it with the town assessment review board and have their taxes adjusted.

He also discussed a new application pertaining to 8 Heathcote Road that has been filed with the Board of Architectural Review. After the BAR denied the homeowners the right to totally demolish the home, they filed a new application to retain some elements of the façade. He questioned why the Village permitted to do so rather than appeal to the Village Board of Trustees. Village Attorney Wayne Essanason explained that the Building Inspector deemed this to be a new application that was not for a total demolition and allowed it to go before the BAR for a certificate of appropriateness.

Scarsdale Library: Trustee Brodsky read a resolution to use $280,000 from the library's fund balance to re-pave the library parking lot and to retain a professional development firm to lead a fund raising campaign for the library.

Greenacres Rings in the Year of the Horse

- Details

- Written by Karen Lee

- Hits: 4307

The first day of the Lunar New Year was Friday, 1/31/14. Celebrated for 15 days, New Year is the most important holiday for many people in Asia. According to the Chinese zodiac, this is the Year of the Horse . In Chinese culture, the Horse is a symbol of nobility, energy, speed and intelligence. There is an old Chinese phrase used to describe someone who is dynamic: he or she has the spirit of a horse.

The first day of the Lunar New Year was Friday, 1/31/14. Celebrated for 15 days, New Year is the most important holiday for many people in Asia. According to the Chinese zodiac, this is the Year of the Horse . In Chinese culture, the Horse is a symbol of nobility, energy, speed and intelligence. There is an old Chinese phrase used to describe someone who is dynamic: he or she has the spirit of a horse.

At Greenacres School, the lion parade is the highlight of its Lunar New Year Celebration, which includes Korea and other Asian countries that follow the lunar calendar. On Friday, 1/31, Ms. Leitner's third grade class led the lion parade throughout the school—armed with Chinese drums, gongs and cymbals. The school's new lion made its debut. It is a Southern Chinese lion,  resembling the lions in the New York Chinatown lion parades, with white fur, a single horn on top of its head, and bold, vibrant colors. The Southern Chinese lion is from Guangdong, China, where early immigrants to Chinatown originated. In addition to the lion, the Greenacres Multicultural Committee also purchased two double-sided Chinese drums, a bulls eye gong and a wind gong for the annual lion parade.

resembling the lions in the New York Chinatown lion parades, with white fur, a single horn on top of its head, and bold, vibrant colors. The Southern Chinese lion is from Guangdong, China, where early immigrants to Chinatown originated. In addition to the lion, the Greenacres Multicultural Committee also purchased two double-sided Chinese drums, a bulls eye gong and a wind gong for the annual lion parade.

Each year, many Greenacres parents collaborate to purchase New Year decorations; decorate the lunchroom, entrances and bulletin boards; make cultural presentations in their children's classrooms; organize a Chinese New Year lion parade as well as give out red envelopes, clementines and other goodies that symbolize prosperity for the coming year. This fun, festive holiday falls on a different day in January or February of each year. And it is always something that the students look forward to celebrating during the cold, bleak winter!

A-School Students Enter the Working World

- Details

- Written by Ali Farfel

- Hits: 10515

At the Scarsdale Alternative School, January internships are a key part of the program. It is one of the first high school internship programs in the United States and was the model for Scarsdale's Senior Option program for graduating high school seniors. For students, January internships provide a break from the intense stress and work routine that accompanies school, and offers a glimpse into the working world and what it might hold for their futures. A-school students in their Sophomore, Junior, and Senior years are required to find internships during the month of January, giving them ample opportunity to learn the basics of many different fields of study that may interest them down the road. There are hundreds of options to choose from, including working at hospitals, photography studios, or even for the Scarsdale Inquirer. Howard Rodstein, Director of the Alternative School, praised the program, saying, "By accessing the working world, we would break open the fourth wall of the school." He also mentioned that students learn to problem solve in a way that you couldn't necessarily learn to in a math or english class. "The students later have an opportunity to reflect on their experiences and share them with the rest of the students," he added. It is one of the most exciting aspects of the year for students who participate.

At the Scarsdale Alternative School, January internships are a key part of the program. It is one of the first high school internship programs in the United States and was the model for Scarsdale's Senior Option program for graduating high school seniors. For students, January internships provide a break from the intense stress and work routine that accompanies school, and offers a glimpse into the working world and what it might hold for their futures. A-school students in their Sophomore, Junior, and Senior years are required to find internships during the month of January, giving them ample opportunity to learn the basics of many different fields of study that may interest them down the road. There are hundreds of options to choose from, including working at hospitals, photography studios, or even for the Scarsdale Inquirer. Howard Rodstein, Director of the Alternative School, praised the program, saying, "By accessing the working world, we would break open the fourth wall of the school." He also mentioned that students learn to problem solve in a way that you couldn't necessarily learn to in a math or english class. "The students later have an opportunity to reflect on their experiences and share them with the rest of the students," he added. It is one of the most exciting aspects of the year for students who participate.

Here are a few experiences of this year's A-School interns:

Here are a few experiences of this year's A-School interns:

Senior Hannah Cooperman, chose to work as a dental assistant for Prosthodontic and Implant Associates in Mamaroneck. She works six days a week, while still attending non A-school classes. Hannah was both impressed by the office and excited to help out. She commented, "I learned a lot on my first day so hopefully I will continue to do that throughout the month." Although she mostly follows the paid dental assistants for now, she is hopeful that as she learns her way around she will be allowed more independence. About the internship program she exclaimed, "I love it. I feel like I have more of a purpose than I do during the rest of the school year and it helps to manage my time."

Another student, junior Austin Serling, is working at Platinum Drive Realty in the Golden Horseshoe. For the company, he will be creating reports by gathering statistics and researching trends in real estate. Austin explained that this data will then be distributed to the clients. "I am working every morning and some afternoons," he said. His first impression of the company was that, "They were all very quick to get to work, and they are always trying hard to get the clients to do what is best for them." As of now Austin has been working a lot with his sponsor, but in the future he will need to work at home, similar to the experience of many adults.

Another student, junior Austin Serling, is working at Platinum Drive Realty in the Golden Horseshoe. For the company, he will be creating reports by gathering statistics and researching trends in real estate. Austin explained that this data will then be distributed to the clients. "I am working every morning and some afternoons," he said. His first impression of the company was that, "They were all very quick to get to work, and they are always trying hard to get the clients to do what is best for them." As of now Austin has been working a lot with his sponsor, but in the future he will need to work at home, similar to the experience of many adults.

While some students have internships that are exciting and fun, others end up sitting and watching. Natalie Keith is a junior who is a very talented photographer. This year she is working as an assistant for Peter Hurley Photography, hoping to learn even more about the art of picture taking. Unfortunately, she is not taking pictures on her own, but "running errands and answering phone calls." Natalie works every day and has to commute back and forth to the city. "It's not annoying to go back and forth," she said of the commute made daily by so many adults. The good thing is that she is very familiar with the city and has no trouble navigating the busy streets. During her first week at work, she was able to observe a photo shoot. "It's really fast paced but a good learning experience," she explained.

While some students have internships that are exciting and fun, others end up sitting and watching. Natalie Keith is a junior who is a very talented photographer. This year she is working as an assistant for Peter Hurley Photography, hoping to learn even more about the art of picture taking. Unfortunately, she is not taking pictures on her own, but "running errands and answering phone calls." Natalie works every day and has to commute back and forth to the city. "It's not annoying to go back and forth," she said of the commute made daily by so many adults. The good thing is that she is very familiar with the city and has no trouble navigating the busy streets. During her first week at work, she was able to observe a photo shoot. "It's really fast paced but a good learning experience," she explained.

Junior Hannah Wolloch has one of the more novel internships this year. Hannah is working with the owner of Gotham Comedy Club and Manhattan Comedy School. "I'm basically promoting their classes and their 'new talent shows' (where people who want to showcase their talent get up and perform rough standup routines at the club). I'm also helping with video shoots and comedy seminars." Hannah works 2-5 hours a day from Monday through Friday and some Saturdays. When asked about the commute by train to the city, she exclaimed, "It's actually one of my favorite parts of the day! It's so relaxing and it gives me time to organize myself before work and relax on the way home." She oftentimes works alongside her sponsor, but has many opportunities to work on her own as well. Her first impressions of the internship were great. Hannah explained, "The environment seemed really cool, but I could tell I would be doing a lot of work." The workload didn't matter to her though, as she was just fortunate that she wouldn't be running pointless errands.

Junior Hannah Wolloch has one of the more novel internships this year. Hannah is working with the owner of Gotham Comedy Club and Manhattan Comedy School. "I'm basically promoting their classes and their 'new talent shows' (where people who want to showcase their talent get up and perform rough standup routines at the club). I'm also helping with video shoots and comedy seminars." Hannah works 2-5 hours a day from Monday through Friday and some Saturdays. When asked about the commute by train to the city, she exclaimed, "It's actually one of my favorite parts of the day! It's so relaxing and it gives me time to organize myself before work and relax on the way home." She oftentimes works alongside her sponsor, but has many opportunities to work on her own as well. Her first impressions of the internship were great. Hannah explained, "The environment seemed really cool, but I could tell I would be doing a lot of work." The workload didn't matter to her though, as she was just fortunate that she wouldn't be running pointless errands.

Sarah Lipsitz, a sophomore who is new to the internship program is working at Kids' B.A.S.E.. She is helping the teachers prepare for class and take care of the kids. Sarah works from Monday to Friday from 3:30 to 5:30 in the afternoon. "I like working there but it's intimidating because there are a lot of people," she said. About the internship experience Sarah commented just that, "It's different being in the working world."

Sarah Lipsitz, a sophomore who is new to the internship program is working at Kids' B.A.S.E.. She is helping the teachers prepare for class and take care of the kids. Sarah works from Monday to Friday from 3:30 to 5:30 in the afternoon. "I like working there but it's intimidating because there are a lot of people," she said. About the internship experience Sarah commented just that, "It's different being in the working world."

Eliza Auchincloss is also a sophomore. She opted to work at the Amber Charter School in East Harlem where she is assisting in a second grade class. Eliza teaches, helps out, and observes all day from Tuesday to Friday. "It's a lot more exhausting than I expected, and it's sometimes hard to work with other people because they get in the way," Eliza said about her first day at work. In addition, she said that the internship is very different from anything she has done before but she likes the independence that comes with it and the ability to work while her friends are in school.

Eliza Auchincloss is also a sophomore. She opted to work at the Amber Charter School in East Harlem where she is assisting in a second grade class. Eliza teaches, helps out, and observes all day from Tuesday to Friday. "It's a lot more exhausting than I expected, and it's sometimes hard to work with other people because they get in the way," Eliza said about her first day at work. In addition, she said that the internship is very different from anything she has done before but she likes the independence that comes with it and the ability to work while her friends are in school.

One of the best parts of the A-School is that it keeps records of all past internships. This way, subsequent students can easily find somewhere they want to work. A-Schoolers seeking internships can visit the A-school schoolwires page and find contact information for hundreds of different employers from all types of companies. These student internships are a great introduction to the working world and what it has to proffer for them.

League's Winter Fundraiser Draws a Crowd

- Details

- Written by Joanne Wallenstein

- Hits: 4428

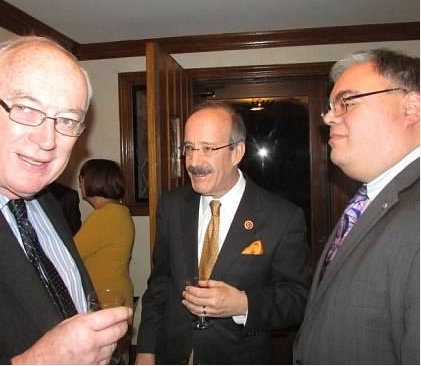

The snow and cold did not deter almost a hundred people from attending the Scarsdale League of Women Voters Winter Fundraiser last Saturday night, January 25 at the home of Ira and Janice Starr. The warm atmosphere was enjoyed by League members and friends including Eliot Engel (U.S. House of Representatives District 16), Amy Paulin (NYS Assembly District 88) , Benjamin Boykin II (Westchester County Legislator District 5), Mayor Bob Steves and many members of the Scarsdale Village and School Boards.

The snow and cold did not deter almost a hundred people from attending the Scarsdale League of Women Voters Winter Fundraiser last Saturday night, January 25 at the home of Ira and Janice Starr. The warm atmosphere was enjoyed by League members and friends including Eliot Engel (U.S. House of Representatives District 16), Amy Paulin (NYS Assembly District 88) , Benjamin Boykin II (Westchester County Legislator District 5), Mayor Bob Steves and many members of the Scarsdale Village and School Boards.

Scarsdale Forum Committee Recommends Adoption of Homestead Tax Raising Taxes for Condo Owners

- Details

- Written by Joanne Wallenstein

- Hits: 13105

The Scarsdale Forum's Committee on Assessment and Revaluation has come out in favor of "The Homestead Tax Option," which would triple real estate taxes for those living in the Christie Place Condominiums on Christie Place in Scarsdale. Currently these units are taxed based on their estimated rental income, rather than their assessed value. That means that a condominium unit owner in Christie Place with a market value of $1.5mm pays approximately $11,500 in real estate taxes, while a homeowner of a single family home of that same value could pay upwards of $30,000 per year.

The Scarsdale Forum's Committee on Assessment and Revaluation has come out in favor of "The Homestead Tax Option," which would triple real estate taxes for those living in the Christie Place Condominiums on Christie Place in Scarsdale. Currently these units are taxed based on their estimated rental income, rather than their assessed value. That means that a condominium unit owner in Christie Place with a market value of $1.5mm pays approximately $11,500 in real estate taxes, while a homeowner of a single family home of that same value could pay upwards of $30,000 per year.

Because the Village is currently undergoing a Village-wide revaluation, Scarsdale has the option of adopting the "Homestead Tax Option " in conjunction with the revaluation. It is estimated that the increase for Christie Place homeowners would be $928,000 in revenue annually. The increase for condo owners would mean a savings of about $160 per year, per household for owners of single-family homes in the Village.

However, residents who purchased the units in Christie Place between 2008 and 2011 were not told that their taxes could triple just a few years after they made their purchase. The units were earmarked for seniors, age 55 and up, most of whom do not have children in the Scarsdale Schools. Many of the buyers were empty nesters who purchased the units because it was a more economical way to retire in Scarsdale than to remain in their homes.

The Forum Committee calls the current valuation method a tax loophole and "concluded that the fundamental need to treat all property owners the same way in valuing their properties, to the extent allowable under the law, requires the Village Board and Board of Education to adopt the Homestead Tax."

The option would first need to be considered by the Scardsale Village Board of Trustees and if passed would go before the Scarsdale Board of Education.

However, all members of the committee were not in agreement. Doug Ulene, a 13-year resident of Scarsdale, resigned from the Forum's Assessment and Revaluation Committee because of its position on this issue, and sent us the following letter:

(From Doug Ulene:) I don't have a dog in this fight, but I strongly disagree with the 200% property tax increase that the Scarsdale Forum's Assessment Revaluation Committee recommends for residential condo units in Christie Place.

(From Doug Ulene:) I don't have a dog in this fight, but I strongly disagree with the 200% property tax increase that the Scarsdale Forum's Assessment Revaluation Committee recommends for residential condo units in Christie Place.

Although the committee's report speaks of "what is fair and right for all the property owners in Scarsdale," and "ensuring that property taxes in Scarsdale are equitably distributed," the committee's conclusion is, essentially, "equality über alles" - triple the property taxes on 42 condominium units, regardless of the expectations of, and the impact on, the affected residents.

Is that "fair"? Is that "right"? Is a targeted change in the manner of assessment on 42 condominium units, in a community with almost 6,000 tax lots, "equitable"? These are questions that should have been asked, and answered, three years ago as part of the Village Board's deliberations concerning the village-wide reassessment. They weren't.

Moreover, the possibility of tripling property taxes at Christie Place was never discussed with Ginsburg Development Companies, the Village's partner in the public/private redevelopment of this site. Adoption of the Homestead Tax Option solely "to eliminate the unfair preferential tax treatment provided to certain condominium units" is little more than the Village unilaterally re-trading its business deal. Such institutional bullying is just plain wrong. It reflects poorly on our community, and it sends a terrible message to the Village's counterparties.

Finally, the Scarsdale Forum's November 2010 report on reassessment - to which I was a signatory - does not include a single reference to "condo" or "homestead." Notwithstanding that omission, the Forum's committee now believes that purchasers of Christie Place condominiums should have researched New York State's Real Property Tax Law before they signed a contract. This belief ignores the reality of residential real estate transactions, and it imposes a burden on individuals that the Forum's committee ignored when it wrote a 22-page report on this topic.

I also take issue with the committee's contention that "There is no principled basis to benefit or subsidize the Christie Place owners over any other group or individual residents..." The signatories to the report have, apparently, forgotten a very important principle - the Golden Rule. If this is how Scarsdale residents plan to treat one another going forward, perhaps we should be more concerned about the values of our community, as opposed to the assessed values of our properties.

I understand that the Village's current tax policy costs my family an extra $160 per year. I am not willing to compromise my principles for that sum – or any other amount, for that matter. I hope others feel the same way.

Below find a information on the Forum's Committee Report that was submitted to Scarsdale10583 by Committee Chair Robert Berg.

Because of the short window in which the Village Board and the Board of Education must act, this Report is being issued under the Forum's Expedited Procedure Treatment. This means that the members of the Forum have not had an opportunity to weigh in or otherwise vote on the Report which will be presented to the General Membership at the Forum's next regularly scheduled meeting on February 6, 2014 at 8:00 p.m. in the Scott Room at the Scarsdale Public Library. All are welcome and encouraged to attend

Preamble to the Report

The Scarsdale Forum's Committee on Assessment and Revaluation is pleased to present to you with its Report recommending that the Village Board of Trustees and the Board of Education adopt the Homestead Tax Option in connection with the completion of the town wide revaluation project this Spring. As you know, the Village Board and the Board of Education held a public joint meeting to address this issue on December 2, 2013. Because of the importance of this issue, the Scarsdale Forum's Committee on Assessment and Revaluation convened and studied the issue. The Committee concluded that the fundamental need to treat all property owners the same way in valuing their properties, to the extent allowable under the law, requires the Village Board and Board of Education to adopt the Homestead Tax Option as soon as possible after the necessary public hearings have been held. Adoption of the Homestead Tax Option will largely diminish the unfair property tax preference afforded to the 42 condominium units in the Christie Place complex. Under current law, the Christie Place condominiums are valued for property tax assessment purposes using the rental income approach, rather than the comparable sales method which applies to nearly all of the residential properties (single family homes) in Scarsdale. Implementation of the Homestead Tax Option will mean that the Christie Place units are valued using the comparable sales method in this revaluation and in the future. A Christie Place unit presently pays only about 1/3 of the property taxes of a comparably priced single family residence. The Homestead Tax Option will eliminate this tax loophole with respect to the Village and School District components of Christie Place residents' property tax bills. The attached report explains the present tax advantage, explores how the Homestead Tax Option eradicates this unjustified advantage, and presents the recommendation that the Homestead Tax Option be implemented to assure the equitable distribution of the property tax burden as best as can be done under the Real Property Tax Law. As the public generally, and the Christie Place unit owners in particular, become aware of the issue -- and the fact that adoption of the Homestead Tax Option may cause the Christie Place unit owners' property taxes to triple -- the Committee hopes that its report will inform the public, the Village and School District, and engender the informed, respectful and engaged discussion that has been the hallmark of the Scarsdale Forum for the past 110 years. We look forward to being part of that dialogue.