School Board Weighs Community Tolerance for a Budget that Exceeds the State Tax Cap

- Category: Schools

- Published: Tuesday, 05 March 2024 15:40

- Wendy MacMillan

The Board of Education held a marathon budget study session on Monday, March 4th where members of the board spent hours, thoughtfully discussing all of the varying factors that shape the proposed 2024-2025 school budget. At the meeting, BOE members learned about proposed budget funds for curriculum, instruction, and assessment, special education and student services, safety, security, and emergency management, interscholastic athletics and technology and innovation. You can watch the presentation on the school website.

The Board of Education held a marathon budget study session on Monday, March 4th where members of the board spent hours, thoughtfully discussing all of the varying factors that shape the proposed 2024-2025 school budget. At the meeting, BOE members learned about proposed budget funds for curriculum, instruction, and assessment, special education and student services, safety, security, and emergency management, interscholastic athletics and technology and innovation. You can watch the presentation on the school website.

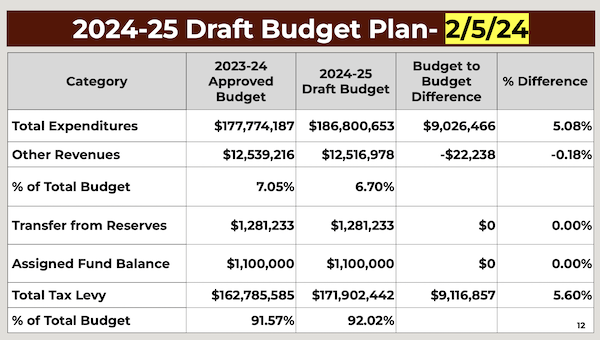

At the previous budget study session on February 5, the administration proposed a 2024-25 school budget of $186.8 mm which would require a 5.6% tax levy increase over 2023-24, exceeding the allowable tax cap of 3.63%. At the March 4th session, they scaled back some of their requests , and reduced the increase in the levy to 4.95%, which is still in excess of the state tax cap. This translates to a 5.26% increase for Scarsdale taxpayers and a decrease of 8.09% for those in the Mamaroneck Strip.

If the Board does propose a budget that exceeds the tax cap, it requires a 60% approval from the community, rather than a simple majority vote.

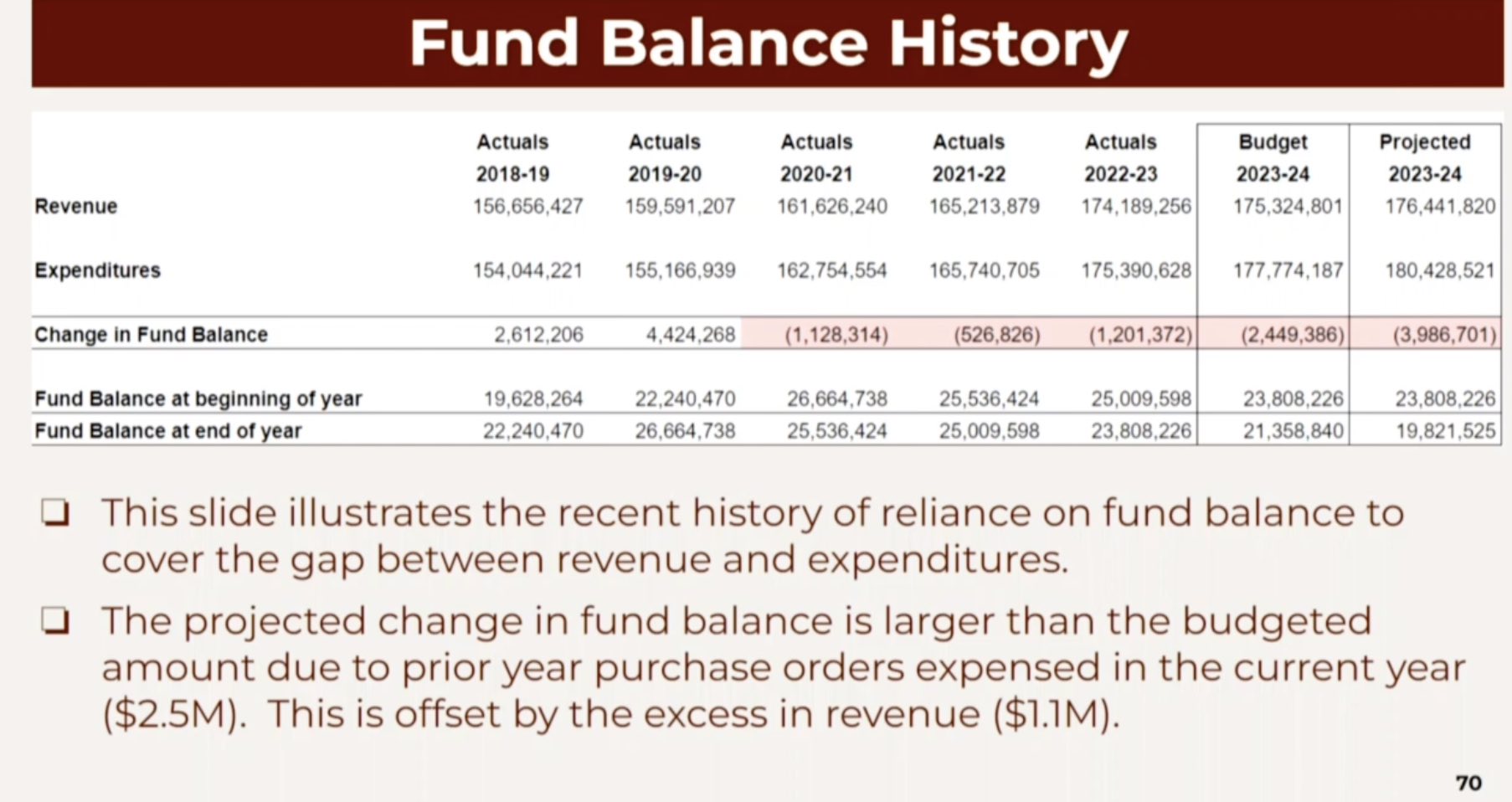

Since 2020, the Board of Education has used the fund balance to keep tax increases below the cap, but reserves are diminishing administrators say this is no longer a good way to balance the budget.

In the following statement Superintendent Dr. Drew Patrick explained where we now stand:

Referring to the slide above he said, "Here is a summary of the budget we presented on February 5, 2024. As a reminder, that budget included 8.9 new full time equivalent positions, some of which are currently in place because they were added through the utilization of budgeted contingency positions. This plan included total expenditures of $186,800,653, representing a $9,026,466 or 5.08% increase over the current year budget, and a projected tax levy increase of 5.60%, nearly 2% or $3.2 million above the tax cap of 3.61%. I want to acknowledge that this came as something of a shock to members of the Board, and certainly to the community, but it reflects the reality that we can no longer do everything we want to do within the confines of the tax levy limit. Indeed, even with the reductions from the preliminary budget that we are proposing tonight, the budget plan currently remains over the tax cap. This is a budget I, and my team, strongly support because we believe it reflects the program we need, and the community expects. With your indulgence, I would like to spend a little bit of time putting this year in the context of the recent past before moving on to the cuts we are proposing and the revised budget draft.

Referring to the slide above he said, "Here is a summary of the budget we presented on February 5, 2024. As a reminder, that budget included 8.9 new full time equivalent positions, some of which are currently in place because they were added through the utilization of budgeted contingency positions. This plan included total expenditures of $186,800,653, representing a $9,026,466 or 5.08% increase over the current year budget, and a projected tax levy increase of 5.60%, nearly 2% or $3.2 million above the tax cap of 3.61%. I want to acknowledge that this came as something of a shock to members of the Board, and certainly to the community, but it reflects the reality that we can no longer do everything we want to do within the confines of the tax levy limit. Indeed, even with the reductions from the preliminary budget that we are proposing tonight, the budget plan currently remains over the tax cap. This is a budget I, and my team, strongly support because we believe it reflects the program we need, and the community expects. With your indulgence, I would like to spend a little bit of time putting this year in the context of the recent past before moving on to the cuts we are proposing and the revised budget draft.

How does this budget compare within the context of recent budgets and tax levies?

We understand the impacts of the tax cap as a check on a period of historically large tax increases (1990’s and 2000’s), but also as a constraint to school board flexibility. Nonetheless, over the past 10 years, our average budget to budget increase is 2.14%, and our average tax levy increase is 2.23%. Over that same time period, our tax levy was below the tax cap by an average of $453,117, or a cumulative $4,531,166. Thus, it is understandable that our preliminary proposed budget may seem inconsistent with this recent past. Notably, one of the ways we have stayed under the cap in recent years has been through the reliance on the use of fund balance to offset expenditures in excess of revenue. That, of course, is not a sustainable practice over the long run, and we are starting to see the impacts of that practice. Andrew will discuss this in more detail later this evening.

Why did we start with such a large proposal?

There are three main reasons for this. First, we are sharing our authentic internal process more transparently than in the past. Second, we have significantly expanded our programs and supports for students in recent years. This has been in response to community expectations, and has been accomplished without exceeding the cap (though see note above about fund balance). Third, inflation and unavoidable cost increases in certain areas have reached a tipping point. Below, I have included detail to each of these reasons.

Our Process

Being quite new to the role of Superintendent, I took the opportunity last year to view the Board-Administration budget development process with fresh eyes. While I played a role in this process in each of my years in Scarsdale, since becoming Superintendent, I have grown to believe that the Board should have a more comprehensive understanding of and transparent window into the internal deliberations that shape the Superintendent’s proposed budget. Thus, starting with last year’s budget, we presented a budget that authentically included our desired program, operational, and capital elements to fulfill our educational goals and objectives, irrespective of the tax levy. This marked a starting point for discussion, deliberation, inquiry, and dialog, both at the Board table and in the community. Over the course of the public budget development process, the Board made informed judgements about the balance between cost and affordability. For those who observed or participated in the process last year, the result--a budget that came in under the tax cap--was only achieved after weighing alternatives, eliminating line items that were initially requested, and making strategic choices about what budget items would have a greater or lesser impact toward our desired student outcomes. Essentially, we aim to replicate that process this year, though the other two reasons stated above will make this process much more difficult this year.

Program Expansion

In any given year, the major budget to budget drivers tend to be contractual salary increases, mandated pension system increases, and benefit increases, particularly in the area of health insurance. Of course, staffing and program additions increase the base budget as well. I think it helps to frame increases both generally and with respect to the preliminary 2024-25 budget, around two frequently asked questions.

Understanding that salaries and benefits (i.e., people) account for 80% of the overall budget, why is the budget going up more than 2% when our labor contracts have kept salary schedule increases to below 2% (recently between 1.5-1.75%)?

Why do we need more staff when enrollment is stable?

It turns out that these questions are interrelated. It is true that our contractual salary increases have been modest, and well below the recent high inflation. In the past ten years, the major driver of our budget increases have been the result of added positions. Over that time, we have added roughly 49 new teacher positions, all while staying under the tax cap. Each of these positions was carefully vetted, and resulted in the introduction of new programming or expansion of existing programming. For example, we introduced a robust STEAM sequence and expanded electives at the high school, significantly increased our mental health staffing to support students and families, and have greatly enhanced our continuum of services and related services supports for special education students. These FTE additions were proposed because they align with our guiding principles of staffing, and they reflect the resources necessary to meet the needs of our students and expectations of our community.

On top of the above, we have also added a safety, security, and emergency management structure inclusive of a Chief of SSEM, and safety monitors at all buildings. This has created a recurring (and escalating) annual cost in excess of $1 million.

Inflation and Cost Increases

The pressure of inflation on goods and services, coupled with cost increases in health insurance, mandated retirement contributions, has largely been absorbed over the years by pushing our budget to the limit, and foregoing some of the desires and requests that come in. While in the past we have been able to generate fund balance by having actual costs that come in below budgeted expenditures, since the end of the 2019-20 school year, this is no longer happening. One representation of this can be found in the $4,531,166 in allowable tax levy under the tax cap that we have elected not to levy and expend. Put simply, we have tightened our belts in response to cost pressures so we could build out the programs described earlier. We are no longer in a position to do this without making difficult choices. Thus, we simply can’t do everything we want to do and that we think is important for our students and families without exceeding the tax. If we think the support of this is not attainable, then we will need to examine ways to reduce our expenditures and make choices about what to keep and what we want to cut. The next several slides will explain the changes we have made to the preliminary draft budget plan.

First, in the past month we have re-examined the entire proposed budget, and not surprisingly we have found a few areas where either our assumptions or our data entry have required revision. There are two items that were not accounted for at the level we expect, and thus they have resulted in adjusted expenditures of an additional $180k.

Our proposed expenditure reductions begin with salary, wages, and benefit costs. We are proposing to defer two of the three special education teaching positions we presented in our staffing recommendations- 1 at SMS and 1 at SHS. At the middle school, the 1.0 position that remains in the proposed budget accomplishes the expansion of the Integrated Co teaching program from 6th grade into 7th grade. The elimination of the second position at SMS, and the elimination of the position at SHS, leaves us at or close to our mandated ratios in the LRC program with decreased scheduling flexibility and little room for new student classifications. Eric will speak more to this during the Special Education budget section.

Next, we reduced the overall elementary staffing assumption by 2.0 FTE, which reflects the elimination of 1 of 2 contingency positions that were proposed, as well as returning a teacher on special assignment to the classroom next year. The final reduction in this area reflects a more precise measure of expected pension costs for civil service employees. This amounts to $705k in reductions.

We have identified another $263k in reductions from equipment, supplies, and BOCES codes. A budget duplication was identified, we scaled back the bus radio purchase by about 25%, we slow down but do not eliminate our deployment of new cameras and door ajar sensors, and defer a needed replacement time-clock system for hourly employees.

Finally, we have made four revisions to contractual codes that would reduce reliance of charter buses for athletics, replacing some trips with school buses, revises our liability insurance premium, removes more duplicate expenses, and suspends (perhaps temporarily) our association with the Advancing Literacy initiative, totalling $285k in reductions. Together, these cuts result in $1,061,281 less expenditures.”

What’s Next

It’s clear that administrators are still greatly wrestling with how to deliver the kind of stellar educational programming that Scarsdale residents have come to expect, while staying within the confines of a state mandated tax cap.

Board President Ron Schulhof said, “This year’s budget is especially challenging, in part due to numerous impacts out of our control. For example, the Governor is proposing a significant cut to our State Aid which we are very actively working to get restored. We have also experienced large increases in health care costs and other operating costs, which are impacting school districts throughout the State.

With so much at stake for the community, Schulhof encouraged all Scarsdale residents to participate in the Budget Study Meetings so that they have a more firm understanding of the nuances and factors that contribute to the budgeting process before deciding how they will vote in May.

Before the next Budget Study Session Dr. Patrick asked the Board to consider questions such as: Where does the Board stand on the proposed budget? What is our tolerance for exceeding the cap? What choices are possible? And should we make more cuts to get below the cap?

Patrick explained that more cuts might mean eliminating additional staff including a half time math teacher at the high school, a special education administrator and some clerical help.

Cost savings in curriculum and extracurricular programs might include reducing arts/aesthetics consultants, cutting back program improvements and reducing the purchase of books for elementary school classrooms.

For athletics, Varsity B teams, their coaches and transportation costs could be cut.

Further savings could come from cutting the budgets for instructional and non-instructional materials and supplies, classroom furniture, the expansion of wi-fi to the hallways and non instruction IT purchases.

All this will be discussed at the next budget study session on March 11, 2024.The Board will formally adopt a budget on April 8 and the Budget Vote and School Board election will take place on May 21, 2024.