Reval Data Demonstrates Inequities in Village Assessments

- Thursday, 27 February 2014 12:09

- Last Updated: Thursday, 27 February 2014 16:06

- Published: Thursday, 27 February 2014 12:09

- Joanne Wallenstein

- Hits: 5180

Some preliminary summary data on the village-wide tax revaluation is now available – and the results are a bit surprising. John Wolham from the NYS Department of Taxation and Finance appeared at a special meeting of the Town Board of Scarsdale on February 25 to review the numbers and put the revaluation into context.

Some preliminary summary data on the village-wide tax revaluation is now available – and the results are a bit surprising. John Wolham from the NYS Department of Taxation and Finance appeared at a special meeting of the Town Board of Scarsdale on February 25 to review the numbers and put the revaluation into context.

He explained that residents will not receive notification of their individual assessments until late March, and that those notices will show what their taxes would have been in 2013 (based on the 2012 assessment) using the new assessments from the revaluation. Actual tax bills based on the new assessments will not go out until April, July and September of 2015. Beginning April 2, those who believe their assessment is incorrect will have the opportunity to make appointments to go to Village Hall to state their case.

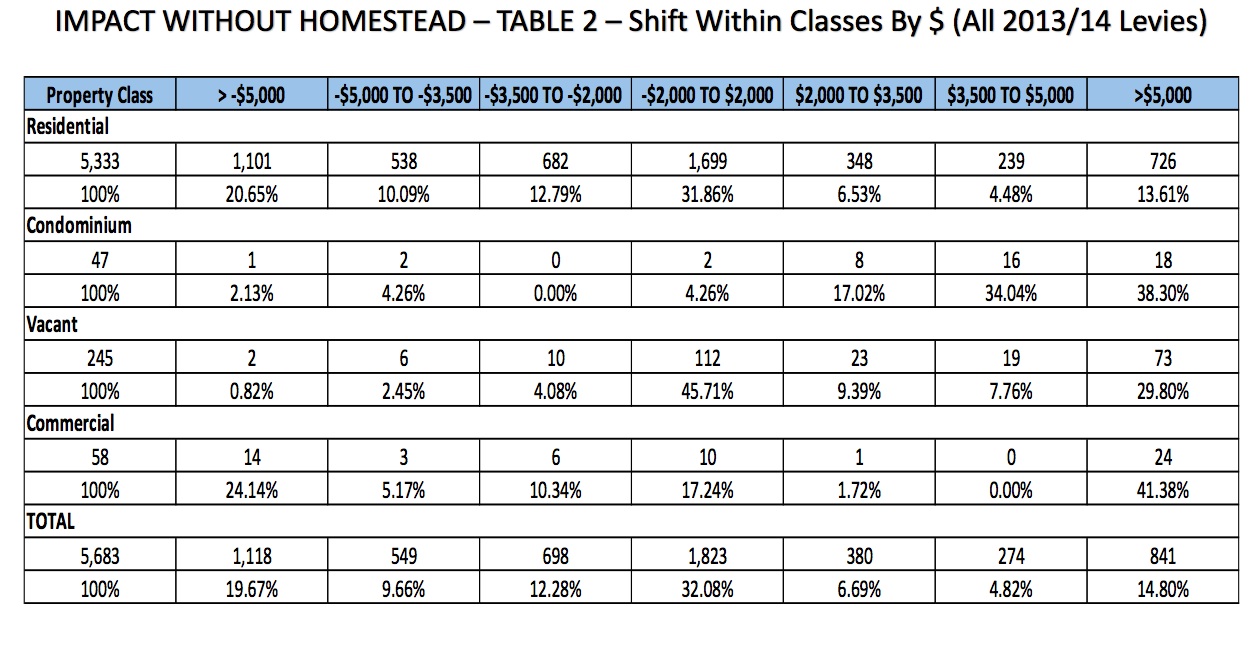

Wohlman presented a series of charts analyzing the overall revaluation and below is a chart that summarized the data.

Basically the chart above shows that currently 43% of homeowners are paying more than their fair share and will see a reduction in their taxes. The chart shows that 682 homeowners (12.79%) paid $2,000 - $3,500 more than they should have, 538 (10.09%) paid $3,500 - $5,000 more than their fair share and 1,101 (20.65%) paid more than $5,000 per year above their newly assessed value.

On the other side of the chart approximately 24% of homeowners were being subsidized by those who were over-assessed. The chart shows that 348 (6.53%) of homeowners can expect their taxes to go up by $2,000 - $3,500, 239 (4.48%) will see an increase of $3,500 to $5,000 and 726 homeowners, (13.61%) will see their taxes go up by more than $5,000 per year.

In the middle of the chart, 1,699 homeowners (31.86%) will see their taxes vary from -$2,000 to +$2,000.

As it's a zero-sum game for the village and a redistribution of who pays what, the total amount of the decrease for the over-assessed has to equal the total amount of the increase for the under-assessed. The 1,313 owners on the right hand side of the chart who will pay more in the future are outnumbered by the 2,321 owners who are getting decreases, so the average increase should significantly exceed the average decrease.

This data assumes that the Village does not adopt the Homestead Tax Option. If the Village does adopt Homestead, a back-of-the-envelope estimate shows that owners of single family homes would see an average decrease of $142 per parcel, while the condo owners at Christie Place would each pay an estimated $12,700 more per unit per year.

Commenting on the data, Wohlman said, "It appears that more people were overtaxed to fund others who were under-taxed. For those questioning why the Village needed to do the reassessment, here is your evidence. There is a tremendous amount of shifting between classes, demonstrating why a reassessment needed to be done."

Additional charts analyzing shifting between classes of real estate, with and without the Homestead Tax Option are available on the Village website here.