Consultants Provide Recommendations for Improvements in the Village Assessor's Office

- Thursday, 01 March 2018 14:00

- Last Updated: Thursday, 01 March 2018 18:26

- Published: Thursday, 01 March 2018 14:00

- Joanne Wallenstein

- Hits: 5511

Following two tumultuous property tax revaluations in Scarsdale in 2014 and 2016, resulting in a lack of confidence in the revaluation processes and assessor's office and an Article 78 proceeding, the Village hired management consultants to examine the assessor's office and the revaluation process.

Following two tumultuous property tax revaluations in Scarsdale in 2014 and 2016, resulting in a lack of confidence in the revaluation processes and assessor's office and an Article 78 proceeding, the Village hired management consultants to examine the assessor's office and the revaluation process.

In June 2017, The Village retained Management Partners for a fee of $34,990 to "Review the assessment department's structure, staffing, policies, workflow processes, and use of technology to identify strategies and best practices that will lead to increased efficiency and effectiveness in the functional responsibilities of the department as well as improved customer service."

After eight months of work, the consultants issued their report and came to Village Hall to present it on February 27. It is available on the Village website here. Though hundreds of concerned and sometimes angry residents had attended prior meetings about the revaluation, only a few people showed up for the presentation. Among the sparse audience were three reporters from the Scarsdale Inquirer, a few members of the Scarsdale Forum and candidates for Village trustee. A recent meeting about recycling and trash pick up drew a much larger group to Village Hall, so it appears that concern about assessments has waned.

The consultant's report contains 41 recommendations for improving the way the assessor's eepartment works both internally and externally, providing suggestions on how the staff should communicate with the public, hire and supervise outside vendors, use technology and more. The recommendations address some of the problems the Village experienced with the 2016 Ryan revaluation, which was done on the heels of the 2014 revaluation.

As background, following the 2014 revaluation, 18% of property owners filed grievances, as many owners of high-end properties who received the largest increases, believed these increases were excessive. As a result, John Ryan, the man who served as the monitor for the 2014 Tyler revaluation was retained to do a second revaluation, without the issuance of an RFP or consideration of other contractors. He had worked well with Village Assessor Nanette Albanese during the 2014 revaluation and she had confidence that he could conduct this follow up revaluation efficiently. But during the process it became apparent that Ryan did not have an adequate team, a sufficient model or a process in place to ensure a quality revaluation.

When the results came in, the Scarsdale valuation was not at 100% of market value, as it should be following a revaluation, but came in at only 89.14% of market value. This led the state to assign the Village an equalization rate. According to the report, "The high percentage of parcel valuation changes, and their significance, inconsistency between parcels and the difficulty in understanding how the changes were made fueled public distrust in the process."

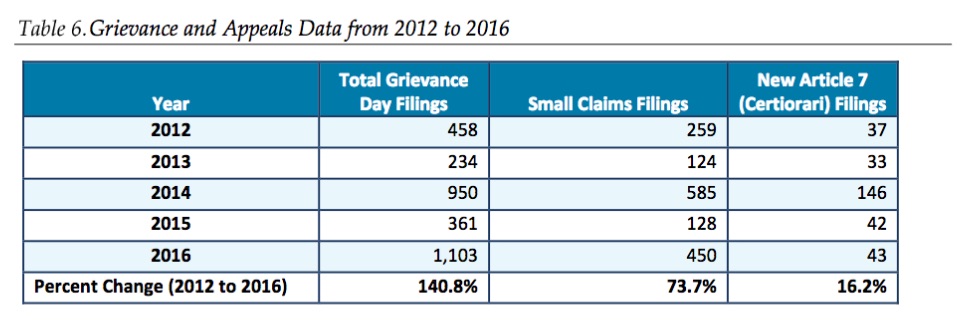

Looking at the history of the number of grievances in Scarsdale it is evident that grievances rose due to mistrust of the valuation process.

The 39-page report includes recommendations for improving the way the assessor's office now works and for planning and conducting the next revaluation. You can read the report online. However here are some highlights from the report.

Staffing:

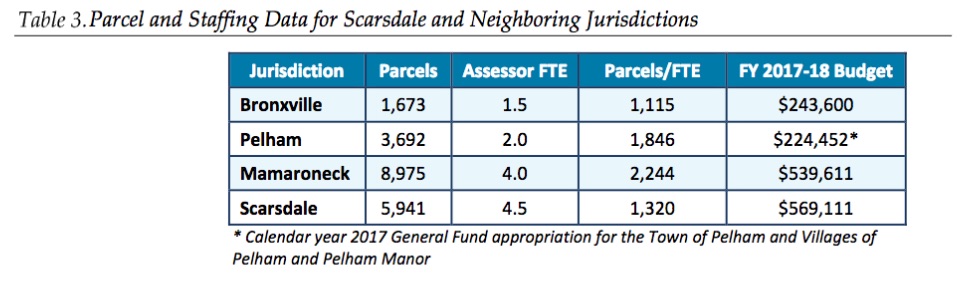

An examination of the staffing of the Assessor's Office in relation to the number of parcels in the Village, shows that in comparison to neighboring towns, Scarsdale's department is adequately staffed and compensation is commensurate. However, they recommended that during a revaluation, staff should be borrowed from other departments or part-timers hired to respond to the public.

The consultants also found that on average, the Assessor's Department spends $142,145 per year for professional support for appraisals, property inspections, data collection, small claims filing and negotiations and legal support for SCAR and Tax Certiorari proceedings." It says, "Given the number of grievances and claims, this level of support is higher than would normally be expected. If the total number of appeals and staff remain at the current level, some level of outside assistance will be needed. However, if appeals decrease and return closer to the pre-2014 level, the appeal workload could be handled in house."

Office:

The consultants analyzed the structure of the assessor's office and the physical layout of the space in order to make recommendations about improving interactions with the public and customer service.

Since so much of the property information is available online, they recommended that a computer terminal with the property records be made available to people who come to Village Hall. They also recommended a redesign of the property information webpages so information can be easily accessed and understood.

Technology:

Inadequate software was also to blame in the 2016 revaluation and consultants found that the assessor's department now uses eight different software packages.

The NYS Office of Real Property Services software is currently being update by the NYS Department of Taxation and Finance. It is scheduled for release in late 2019. It will be "a consolidated web-based system, rather than the current patchwork of separate software installations that run on individual computers."

In order to address their technology issues, the consultants recommend that the Village "research and purchase an assessment software package that meets industry standards and facilitate future mass appraisal revaluations."

Interactions with the Public:

Addressing claims that the personnel in the assessor's office were rude and not helpful, the consultants recommended the staff go through customer service training to improve communications skills and transparency.

Poor communications were also cited. The consultants found that "some residents do not trust the results of the two recent revaluations," and recommends that a communications plan is developed to increase transparency and build trust. They found that there were inconsistencies in the way information was provided and therefore recommended that the Village "Provide notice to property owners about data changes through a variety of communication channels and allow ample opportunity for response as part of each assessment or revaluation." They suggested that the village produce videos to explain the assessment process and air them on local cable channels.

These videos could also be used to explain the importance of allowing an inspector inside the house as part of the assessment process or to guide a resident through the grievance procedure.

Best Practices:

The consultants looked at a few other municipalities and determined that they used "transparent and sound procedures, frequent communications with property owners to develop trust in the process." All three of these towns conduct annual review of town/village wide property valuation trends through sales data, to maintain accurate up to date parcel values. As a result, the report claims that "Residents have accepted frequent changes to their property assessments which is reflected in steady decline of grievance filings."

The consultants made the following recommendations concerning a future revaluation.

- It should be carefully planned with more public outreach and engagement

- It should allow for mid-course corrections when needed

- The software solutions should be considered in advance.

- A monitor should be hired to provide oversight of the vendor.

- Staffing of the Assessor's Office should be supplemented during the revaluation.

- Annually sales trends analyses should be done to see if certain neighborhoods need to be adjusted.

- A Village-wide assessment should be conducted no less than every five years

The consultants also sought to avoid future issues with hiring vendors to do the work. They suggested the use the RFP process for all future reassessment projects, using the ORPTS RFP as a template.

Other recommended steps include:

-Holding a meeting with contractors prior to submission of proposals to answer questions.

-Interviewing prospective contractors "about their experience and knowledge about property attributes in general, and conditions similar to Scarsdale.

-Establishing a committee to assist with the evaluation of the consultants and to select the vendor. The report recommends that the committee be selected by the Village Board and include the assessor, Village attorney, a representative from the Village Manager's office and possibly a tax attorney, property appraiser, real estate agent or other professionals.

-The Village Assessor be responsible for the RFP process and that a clear and consider explanation of responsibilities, along with a detailed project timeline is provided to all contractual parties including the monitor, the contractor and the staff of the Assessor's Department.

In addition to outlining procedures, the report recommends that the model and methodology for conducting the valuation estimate calculations is included in the required documentation provided to the Village.

The report goes on to make recommendations concerning the Board of Assessment Review and the grievance procedure which you can review here:

It concludes by recommending that for the next revaluation "there is a fully transparent process, ample communications and clear instructions for property owners."

Following the presentation by Kevin Knutson's of Management Partners, Trustees and the public were given the opportunity to ask questions.

In response to the recommendation about the assignment of a revaluation committee to supervise an RFP, Knutson said, "They're good for all kinds of large scale projects." However his colleague Thomas Frey admitted that he "did not know of any local communities that created such a committee."

Trustee Callaghan said, "All of a sudden it turns out Ryan is a flim-flam man. How do we avoid that in the future?" Knutson recommended an RFP process and calling references.

Trustee Marc Samwick thought the report had not gone far enough. He said, "I thought you would look at other towns and pick out best practices and learn from the more positive experiences. ... I was expecting more meat on the bones for how we can learn from them. ... Bronxville does their valuations in house. We also discussed that Bronxville had a higher number of grievances than usual this year – why? That wasn't given enough attention in this report."

Knutson replied, "We are focusing on what you can do today to make it go better."

Samwick continued, "I was hoping to find communities that minimized grievances and why? Is there any trending analysis for each of these communities? How can we compare? Did you look at the assessor's offices FTE's in relation to how many parcels there are? It looks like we are almost staffed to do this in house."

Carl Finger asked, "If you have the data – can you supply it at a later date?"

Trustee Callaghan turned to page 36 of the report and read, "A high level of care should be taken during the next revaluation to make sure there is ample communication etc. What do you think the timeframe should be?"

Trustee Veron said, "So much planning is needed in advance – we should start to think about this now."

Trustee Samwick, "You recommend tighter controls to allow for midcourse corrections when needed? Frey responded, "You need milestones in place – if you start to see that these dates aren't being met, you have to take steps."

In public comments,

Lee Fischman said, "The Forum's Assessment Committee is drafting a report that will probably be ready in the spring. It will be more forensic and technical in nature.

You can use this as well as a resource."

Justin Arest said, "I look forward to the additional data that has been requested. I would appreciate more information about the recommendations. Please elaborate why something is best practice and please provide the back up."

Bob Berg said, "I was not in favor of hiring a consultant. I thought it would be a white wash. But now I think it's a gray wash – it's a C+. It's written in a way to protect the current office. We lose from that. We could do a better job solving the issues. That said, if you read between the lines, you learn a lot. We are paying more, we have a lighter workload, and we had a disastrous result. It doesn't do it to say "improve customer service." You don't address how that Ryan reval came about. Why did that happen? Is it common to do one right after another one was done? Tyler was at 100% valuation and Ryan was at 94% - that was a disaster and you don't go into why that happened."

Steve Pass asked,"Did Mamaroneck provide the mathematical model used in their reval to residents?" Frey replied "no." Pass asked, "Did the Town have access to the mathematical model used?" Frey said, "I am not sure."

Michael Levine said, "You make it clear that you did not analyze the methodologies or review the results of the previous revaluations. You might have made different recommendations if you had reviewed the revaluations. ...There is a lot about procedural fairness, but there's nothing about unfair results. Without being on guard for this, you're not defining that this has to be done. The report assumes that the revaluation will be done correctly. It does not deal with the potential problem that the revaluation will be substantively insufficient...Can it be done fairly – can it be defended as fair? Are those mechanisms in place? "

The meeting concluded with the consultants agreeing to provide implementation steps for all their recommendations and additional data on the other towns they studied.