Budget Discussions Continue at Scarsdale BOE - Tax Cap Could Be Above 3%

- Thursday, 12 December 2013 08:18

- Last Updated: Saturday, 14 December 2013 13:26

- Published: Thursday, 12 December 2013 08:18

- Joanne Wallenstein

- Hits: 6725

Assistant Schools Superintendent Linda Purvis shared some interesting news about the estimated tax cap, the health reserve and elementary school expenses at the December 9th meeting of the Scarsdale School Board.

Assistant Schools Superintendent Linda Purvis shared some interesting news about the estimated tax cap, the health reserve and elementary school expenses at the December 9th meeting of the Scarsdale School Board.

Tax Cap:

Recently released numbers from the NYS Office of Real Property Services shows that the total assessed value of Scarsdale real estate has gone up more than anticipated last month. The new estimate is an increase of 1.66%. When added to the state cap, this would make Scarsdale's cap around 3.25%, and would make it easier for the Board to propose a 2014-15 school budget that complies with the cap while including funds for building maintenance and improvements, staffing and programming.

Health Reserve

However, Purivs also reported that the district will need to dismantle the $1.6 million dollar health reserve that the district's external auditors have now ruled to be out of compliance. She gave the Board three options for liquidating the reserve:

1) Dismantle it over four years in equal increments

2) Take the entire reserve into income for 2014-15

3) Transfer $750,000 of the health reserve to the undesignated reserve to bring that fund up to4%, which is permissible by state law.

The Board will discuss these three options at a later date.

Elementary School Program Costs

Last, as part of a presentation about the elementary school program, the Board distributed a page of "Financial Facts and Figures" about the elementary schools and here are a few observations.

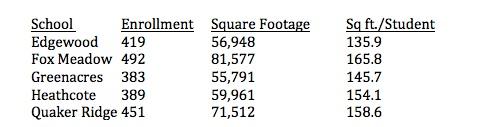

The five elementary schools vary in enrollment from a low of 383 students in Greenacres to a high of 492 students in Fox Meadow. Building square footage reflects enrollment varying from a low of 55,791 square feet at Greenacres to 81,577 to a high of 81,577 square feet at Fox Meadow.

Here are the statistics about the number of square feet per student at all five of the schools:

School Enrollment Square Footage Sq ft./Student

Therefore, Edgewood and Greenacres are the most densely populated.

Another interesting fact to note: for the elementary school program, salaries and benefits account for $34,726,781 in costs out of a total budget of $36,006,707, or 96% of the elementary school budget. This includes texts, supplies, extracurricular stipends, professional development grants, technology hardware purchase, student accident insurance and building utilities, but does not include special education costs or an allocation for Central Office expenses.

Public Comments

The news that the cap could be above 3% was not music to everyone's ears. During the public comments portion of the meeting, four men, who have frequently spoken out against tax increases, asked the Board to contain costs and minimize budget increases.

Here is what they said:

Former Board member Michael Otten urged the Board to use "zero based budgeting," to compare district costs with other comparable districts, to eliminate programs that are not working as expected and to undertake "a major review of the 2014-15 school budget." He told the Board, "We don't need reams of extra paper or more meetings. Reserves, professional development, and travel are areas that need more clarity. The tax cap is not the principal driver for a balanced budget."

Robert Berg, who led the movement to turn down the first school budget in May, 2013 warned the Board to "heed the message from last year's budget defeat." He said the defeat was "the voice of the silent majority who said, "I can't take it anymore." He claimed the vote was not just about the fitness center and read a letter from a 78 year-old retiree thanking Berg for his "profound analysis of the bloated proposed $144 mm school budget -- adding, "I do pray that the powers that be have heard the message "enough is enough."

Mitch Gross, another frequent critic of the Board said, "Scarsdale has passed the tipping point where there are decreased returns from increased taxes." He said, "The housing stock is static," yet the student population has grown. He continued, "Scarsdale has the lowest student teacher ratio and teachers are the highest paid ...

The more you tax, the faster people without children move out. They vote with their feet. We can debate if they are shirking their responsibility." Quoting Margaret Thatcher he said, "Educational experimentation is great until you run out of money." He argued that Scarsdale taxes were increasing at an "unsustainable rate" and asked the Board to reduce the total spend, to examine teacher compensation, course load, and capital expenditures.

Jim Labick of Brookline Road said "a rollover budget is a flawed way to come up with a budget." He told the Board that in his years in business, "We never started with the existing budget. We use zero-based budgets and determined what needed to be done differently." He asked the Board to "eliminate programs and scrutinize all programs for their true value added."

Though it is early in the budget process, many are already engaged in airing their views. The days in which the approval of the Scarsdale Schools budget was a forgone conclusion appear to be history. It could be another season of late nights for the administration, the Board of Education and the community.