The Sidewalk Sale Is On, Thursday-Saturday in Scarsdale Village

- Details

- Written by Joanne Wallenstein

- Hits: 1616

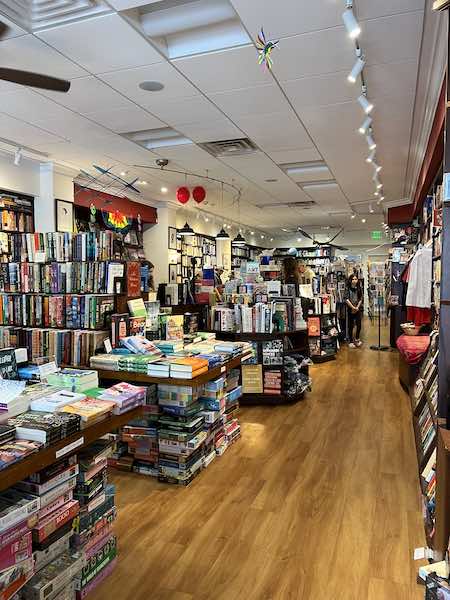

The long-anticipated Scarsdale Sidewalk Sale is on from Thursday to Saturday from 10 am to 6 pm and the Village is alive with shoppers and deals.

The long-anticipated Scarsdale Sidewalk Sale is on from Thursday to Saturday from 10 am to 6 pm and the Village is alive with shoppers and deals.

Buyers lined up in front of Pamela Robbins before the 10 am opening on Thursday to get first dibs on designer clothing bags and shoes. Next door at Rothmans, racks were filled with sports jackets and shirts, and there were great prices to be had on designer swim trunks, shorts and more.

Another hub of activity was I Am More Scarsdale, where racks and tables spread down Spencer Place and onto Harwood Court. There were bags, hats, jeans, tops, cover-ups, shoes and more, also at bargain prices.

Along Boniface Circle, vendors who don’t have bricks and mortar stores in town set up tables. We sampled macaroons from Woops at the Westchester, chatted with “educationist” Kristen Zakierski who was featuring her new line of learning materials for young children, admired the colorful artwork of Amanda Arbeter, and spoke to representatives from Audio Help who just opened a new store on Popham Road with hearing aids and other audiology devices.

At 44 East Parkway we met the team from Contour Med Spa Services who are opening at new location in September, offering a full range of facials, fillers, threading, microneedling and more. We saw lots on sale at Bronx River Books and Learning Express too.

Be sure to bring children to the Village on Saturday July 27 between 11-2 when there will be facepainting, a balloon artist, music, games and more for kids on Spencer Place. The games will be run by the Scarsdale Youth Business Alliance.

Parking is tight so plan to walk, cycle or catch a ride to the Village.

Trustees Consider Plan to Alleviate Flooding in Sheldrake Watershed

- Details

- Written by Joanne Wallenstein

- Hits: 1587

What’s going on with plans for improving drainage in Scarsdale?

What’s going on with plans for improving drainage in Scarsdale?

One of the big ticket items in this year’s budget was spending to relieve flooding in many troubled areas of the Village -so on Tuesday July 16, the Mayor called a work session to review the progress of the Department of Public Works and Village Engineer on a long list of projects.

Before turning to an analysis of flooding across the street from the Scarsdale Middle School, Supervisor Jeff Coleman ran through a list of smaller projects that are now in process.

Among them are:

-Improvements at George Field Park, Cambridge and Rugby Roads to alleviate flooding are underway.

-On Cushman, Garden, Sheldrake and Willow Roads the Village is doing an analysis of the stream, creating a hydraulic model and is close to making some recommendations for work to be done.

- Replacement of a culvert at the end of Griffin Road.

-Stormwater remediation in Fox Meadow at the intersection of Ogden and Paddington Roads, and also on Chesterfield Road between Brite Avenue and Oak Lane.

-Library Pond where bidding for a project to address flooding at the pond will start in a month or so.

-Hutchinson River Stormwater: The Village is working with the City of New Rochelle on improvements to the Hutchinson River with the project to go out to bid in August and work to begin in the fall.

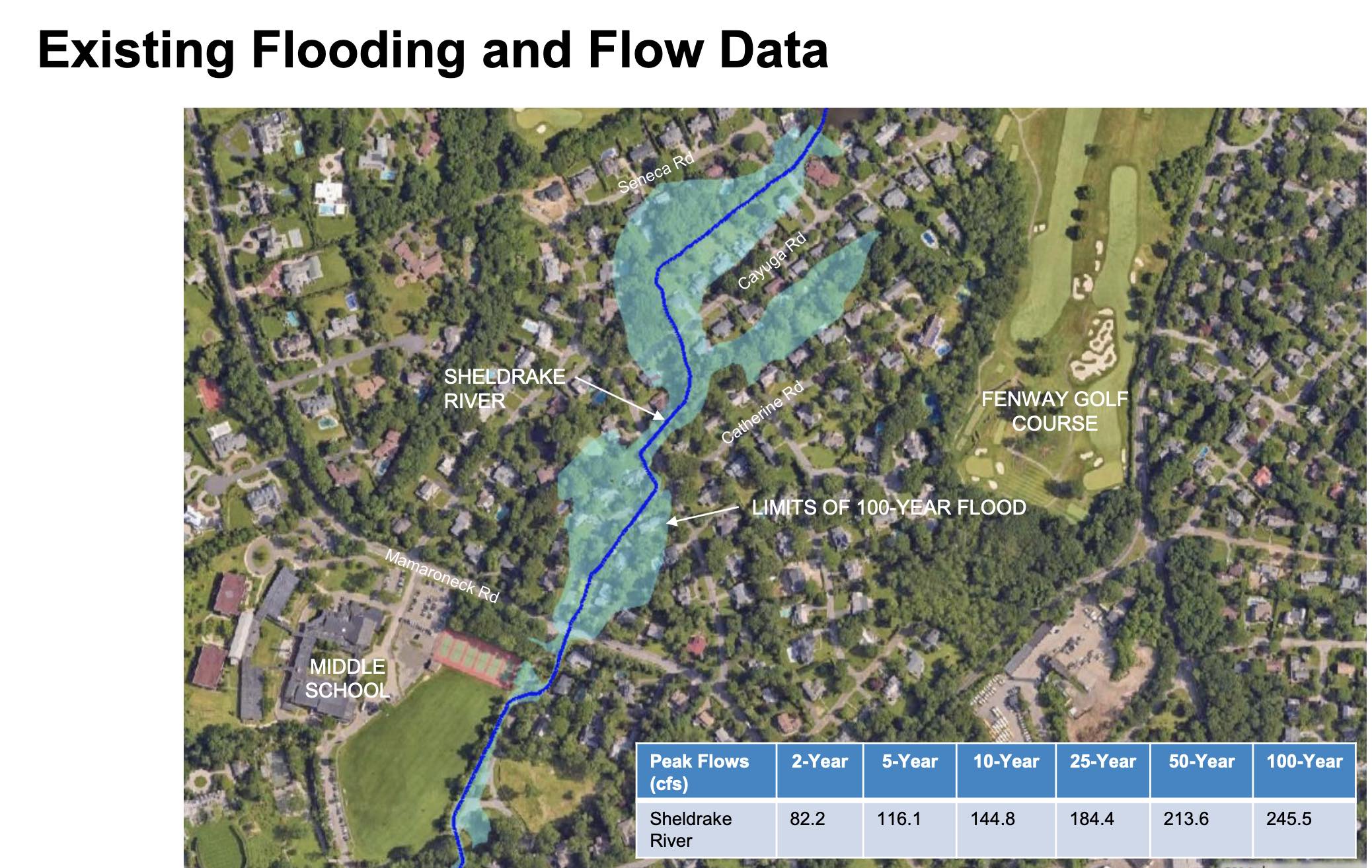

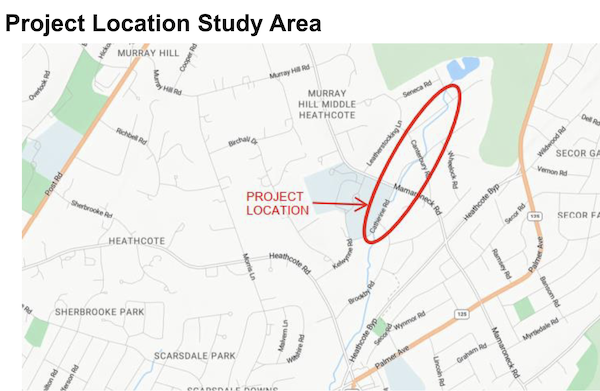

However, the reason for Tuesday’s meeting was to review possible solutions to extensive flooding in the neighborhood across from Scarsdale Middle School at Catherine, Leatherstocking, Oneida and Cayuga Roads. Coleman said this neighborhood “was one of the hardest hit,” and engaged engineering consultants to look for possible solutions. Residents have been lobbying the Village for more than a decade to do work to safeguard their homes which flood extensively when there is heavy rainfall. They estimated that the flooding affects about 20 homes which were built in a FEMA flood plain. Here is an article from 2012 on Scarsdale10583 discussing the flooding:

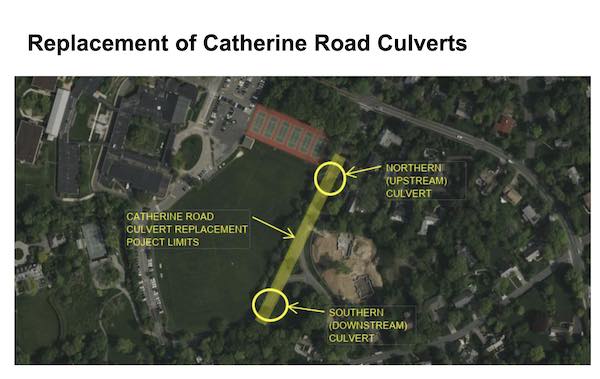

John Ruschke, an engineer with Mott McDonald explained that a 700 acre watershed of the Sheldrake River drains into this area causing substantial flooding on Catherine and Cayuga Roads. The engineer presented a study that examined three alternatives to significantly improve the situation, in what has been designated a FEMA flood plain.

The three alternatives were:

Replacement of Catherine Road Culvert: They looked at enlarging the culverts and lowering the channel between them. However, their analysis did not show that this would provide an improvement.

Second they looked at upstream drainage improvements and examined the effects of eliminating a 50 acre portion of the drainage area in the rear of properties on Catherine and Cayuga Road. They would create a bypass culvert and redirect the flow. However, this proposal was also found to have an Insignificant benefit. to removing 50 acres.

Last, they analyzed the effect of a total replacement of the Cayuga Road culvert and the installation of a 10 foot by 4 foot bypass culvert that would run from Canterbury Road between Cayuga and Catherine Roads that will extend downstream in the vicinity of the middle school, just downstream of Mamaroneck Road with a replacement of the Cayuga Road culverts with a new 10’ wide by 4’ high culvert.

Last, they analyzed the effect of a total replacement of the Cayuga Road culvert and the installation of a 10 foot by 4 foot bypass culvert that would run from Canterbury Road between Cayuga and Catherine Roads that will extend downstream in the vicinity of the middle school, just downstream of Mamaroneck Road with a replacement of the Cayuga Road culverts with a new 10’ wide by 4’ high culvert.

In this proposal, water flows would be redirected deposited at the middle school where retention basins may need to be installed under the fields. This would eliminate all the chokepoints and the bottle neck and should yield significant benefits.

Additional work needs to be done to determine the size of the culvert. Cost analyses will also be needed to determine how much it will cost to do the installation which will interfere with the water, gas and sanitary lines that run underneath Catherine Road.

In the discussion that followed trustees asked if the project would affect neighbors downstream. The Mayor asked if there are existing maps of Scarsdale’s stormwater infrastructure and the response was that there is not a complete map, but that the Village is working on building one as a part of the process of designing these projects. The Mayor said, “We have $6 million in this year’s budget for drainage improvements – would it help if we allocated some of that to mapping? Would that speed things up?”

A resident from Cayuga Road said, “It is not just backyard flooding – it affects our homes. We sustained $120,000 during Hurricane Irene and $100,000 during Ida – it is a significant amount of damage. Any fix you make will impact all of us. We have a vested interest in this project. Any small improvement that you make will benefit us.”

A doctor from Cayuga Road said, “The patient is dying, Scarsdale is not a wildlife preserve. The last storm cost me $200,000. Do you know which homes were flooded and to what degree? We are talking about people. You are disrupting people’s lives when you get 5 feet of water and stool in your basement. It disrupts our lives every time in rains. See who is being affected by the flooding – and where you can store the water.”

Supervisor Coleman assured him, “I appreciate that you are passionate about. But you are preaching to the choir – we are all looking for the same solutions. We are going to move the water downstream to the middle school. We need to analyze how much storage is needed.”

Asked how long it would take to get this done, Coleman said plans would need to be finalized by the end of the year. Then the Village would apply for grants which might take several years. So it did not appear this would be quickly.

As the project could cost millions to implement, one trustee asked if it might be best for the Village to take a few of the flooded homes by eminent domain rather than spend millions protecting them. This enraged one of the residents assumed that he would not receive fair market value for his home.

At the close of the meeting, Village Engineer Dave Goessl explained, “Scarsdale is surrounded by three watersheds, the Sheldrake River, Hutchinson River and Bronx River basins. We are shedding water to our neighbors.”

Discussions about alleviating stormwater inundation in flood-prone areas are taking place at the same time that the Planning Board is considering applications to build in more flood prone neighborhoods. On their agenda is construction of a new home over an area that was formerly a pond at 46 Lincoln Road. In addition, applicants are continuing to seek approval to build up to eight homes, with swimming pools, in a swampy watershed next to the water tower at 80 Garden Road.

Given the Village’s experience with allowing construction in wet environs, it’s not clear why the trustees don’t take measures to prevent future building in areas that have historically flooded.

Remembering Kenneth Weiser and Stephen Seward

- Details

- Written by Joanne Wallenstein

- Hits: 1821

Scarsdale recently lost two members of the community. Here are remembrances for Kenneth Weiser, a 70 year Scarsdale resident and Stephen Seward.

Scarsdale recently lost two members of the community. Here are remembrances for Kenneth Weiser, a 70 year Scarsdale resident and Stephen Seward.

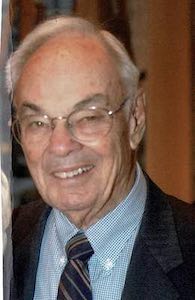

Kenneth David Weiser

Born December 1, 1924, died June 6, 2024.

Adored husband of Carol (nee Kane) who was the love of his life for over 74 years. Beloved father of Robert (Susan), Betsy (Eric Karp) and Ned (Nancy). Loving grandfather of Jeffrey Weiser, David Weiser (Jessica), Emily Karp (Derek Miller), Andrew Karp (Danielle), Jenna Karp, Kate Weiser, Chloe Weiser and Phoebe Weiser. Extraordinary great grandfather of Zachery, Matthew, Zelda and Olympia Weiser and Lucas Miller. Cherished brother of Marcie Blauner.

He graduated from Columbia College in 1947 and Harvard Business School in 1949. While serving during WWII, he was wounded in the Battle of the Bulge, receiving a Purple Heart. In 1949, he joined his father’s CPA firm M.R. Weiser & Co. and was instrumental in its growth and success. He was a man of fine judgement, character, and intelligence. He headed Federation’s Distribution Committee, was President of WJCS, and was Treasurer and Board Member of Montefiore Medical Center for many years.

His varied interests included world travel, reading, organic gardening and sports. He was an inspiration to his family and will be remembered with admiration and love.

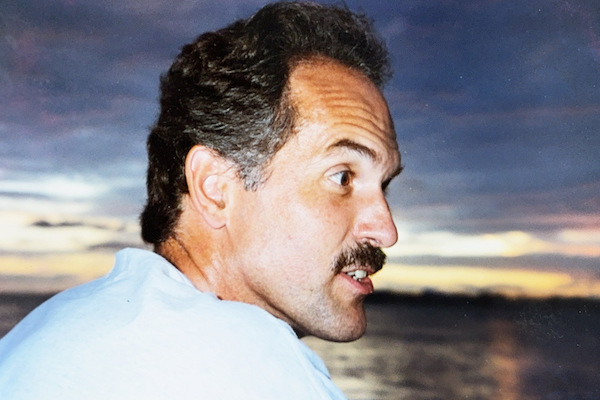

Stephen Seward

Stephen Clark Seward died on June 14, 2024, surrounded by family at Greenwich Hospital in Connecticut. He was 75.

Steve could connect with anyone he met, and usually did, always eager to engage, debate, and learn about other people’s lives. He turned that gregarious personality into a long and successful career as a charitable fundraising coach, advising countless non-profit organizations in the course of his life, from the Jewish Child Care Association and The Boys’ Club of New York to Educate! in East Africa. His work helped to raise hundreds of millions of dollars for causes important to him and society.

Serving others was important to Steve. He was a branch director in the Union City Public Library system; executive vice president of the John O’Donnell Company, a fundraising consultancy; director of philanthropy for the Nature Conservancy in New York; and executive director of the Scarsdale Schools Education Foundation; among other roles dedicated to public service. He gave much of his free time to non-profit work, as well, most recently serving as president of the Litchfield Hills Rowing Club (LHRC).

Born in Queens, New York, to Phyllis Clark and Rossiter Seward, “Stevie,” then Stephen, and then Steve grew up there and in Wayne, New Jersey, and Hillburn, New York, with his siblings Doug, Dave, and Cindy. He was student council president and captain of the tennis team at Suffern High School before going to Amherst College, where he studied political science and dedicated much of his time to political organizing and opposition to the Vietnam War.

After graduating, Steve worked for the progressive newsweekly The Guardian. He then got a master’s degree in library science from the University at Buffalo and ended up at the Foundation Center in New York City, where he met a coworker, Sherry Moses, whom he fell in love with and married in 1982. Their early years in the city were filled with theater, which Steve continued to enjoy his entire life.

Sherry and Steve moved to Ardsley and then Scarsdale, New York, to pursue careers in philanthropy and raise their son, Zach, whose love of journalism owes to the newspapers and magazines that Steve stacked on the kitchen table. In his suburban years, Steve was a Little League coach, synagogue advisor, and of course fundraising consultant to many local charities.

Dave Shuster of Scarsdale said the following, "I’ve been with the Scarsdale Schools Education Foundation from its beginnings, having been its treasurer. I worked closely with Steve. Steve was a consultant to SSEF before becoming its executive director from 2013 to 2018. He was highly knowledgeable and experienced in the 501c3/non-profit space, and an invaluable resource. Without him, SSEF could not have moved as fast and efficiently as it did to raise the funds and thereby provide the $2.25 million of grants that it made to SUFSD for the fitness center and design lab at the high school. Steve was always a pleasure to work with, a true gentleman. He was a great credit to Scarsdale. He will be missed, but his spirit and legacy lives on in what he helped bring to the Scarsdale Schools."

Beth Zadek added, "Steve became involved with the Scarsdale Schools Education Foundation in 2012 and became its Executive Director in 2013, steering it from its founding until the completion of its capital campaign in 2018. His deep experience in the non-profit world guided us every step of the way. His input was invaluable and he brought a depth of knowledge about process and fundraising that has been integral to its success. More important, Steve was optimistic and thoughtful, ever the cheerleader in all circumstances. He continued to be in touch after his retirement, always generous with his time to answer questions. The Foundation would not have achieved its success without his wisdom."

When he and Sherry began spending more time in Roxbury, Connecticut, they became active in the local organizations like the Connecticut Community Foundation, where Steve was a board member for six years. He also took up rowing and came to relish early-morning practices on Bantam Lake and weekend regattas with LHRC teammates, who recently honored him by naming one of the boats “Seward’s Folly.” He proudly rowed The Head of the Charles in 2022.

Steve is survived by his wife Sherry Seward; his son Zach Seward and daughter-in-law Kate Lee; his grandchildren Hugo and Nicholas Seward, who were the center of Steve’s universe in the last decade of his life; and his siblings Doug, Dave, and Cindy Seward.

Customer Attacks DeCicco's Manager

- Details

- Written by Joanne Wallenstein

- Hits: 5207

As if things at DeCicco’s in Scarsdale Village aren’t hard enough, a crazed customer on a scooter made things even more difficult a few weeks ago.

As if things at DeCicco’s in Scarsdale Village aren’t hard enough, a crazed customer on a scooter made things even more difficult a few weeks ago.

First rumors were swirling that the store was going out of business. Shelves grew emptier and even essentials like milk, eggs and butter were scarce. Though locals wanted to support the store, it was tough to be loyal when they were unable to find what they needed.

Manager Walter Wadwick was busy reassuring customers that shelves would soon be stocked and the store would return to normal when a bizarre incident shook him to his core.

It started on Tuesday June 4 when a customer on a scooter arrived with cans and bottles on board to get credit for his returns. He put the bottles and cans in the machine outside and then came inside with his receipts in hand to give to the cashier for credit. The cashier was unable to scan the bar codes and had to input each code by hand. The customer got antsy and then angry and started to berate and curse the cashier. Another customer was on line behind the man was in a rush and attempted to give $5 to the cashier for her coffee so she could leave. The angry man took her on, yelling “Shut the fxxx up – you don’t know who the fxxx I am.” The cashier was frightened but eventually gave the man his money and he left the store.

The following day, Wednesday June 5, the man on the scooter returned, but this time the cashier was able to alert Walter, the manager.

Walter went to the front of the store and pretended to be a customer. The angry customer was cursing into the air and Walter turned to him and said, “It sounds like you are having a bad morning. Please leave the store.”

More agitated, the man yelled at Walter, saying “Who the fxxx are you? You don’t know who you are talking to.”

The manager again urged him to “Please buy your stuff and leave.”

The man then moved into Walter’s face, until their noses were touching. Walter pushed him away. Then the customer spat on him twice. Walter turned around to call the other store manager and when he turned around again the customer took him by surprise, clobbering him in the face with a closed fist and throwing Walter to the floor. Walter hit his head hard and passed out from the impact of the assault. Fortunately, his glasses flew off rather than breaking and cutting his face.

When he came to, he found himself sitting in a chair at the back of the store. SVAC arrived and took measures to revive him and guided him into the ambulance to take him to the hospital. The man left quickly on his scooter before he could be apprehended.

After leaving the hospital Walter signed an order of protection against the man which would bar him from entering the  store.

store.

But a few days later, on June 10, the assailant appeared again on his scooter. This time Walter called 911 immediately. Police arrived quickly, arrested him, and put him into the police cruiser. He was brought to headquarters, arrested for assault in the 3rd degree and given a court appearance date. He was identified as Robert Mahoney, age 47 of Yonkers and has been seen around Scarsdale on his scooter since the assault.

Walter says, “At 61 I have never had anyone spit on me. I am alive and it could have been a lot worse.” About Mahoney he warned people to steer clear of him and said, “He should get help.”

Will the Proposed Building Code Changes Solve the Problems?

- Details

- Written by Joanne Wallenstein

- Hits: 1044

Racing to have new land use code in place so that Scarsdale’s Building Moratorium can be lifted, the Village Trustees held a work session prior to the 6-11 Board of Trustees meeting where they reviewed suggested revisions to the proposed code with consultants BFJ. See the memo here:

Racing to have new land use code in place so that Scarsdale’s Building Moratorium can be lifted, the Village Trustees held a work session prior to the 6-11 Board of Trustees meeting where they reviewed suggested revisions to the proposed code with consultants BFJ. See the memo here:

The consultants were originally charged with making recommendations to:

-Reduce stormwater flooding

-Reduce the appearance of home bulk

They came back with a long list of small adjustments to current Village code and new requirements for Planning Board Review for projects where there would be land disturbance above specified thresholds. They also suggested new “open space” percentages to guarantee more permeable surfaces and recommended that the Village change the definition of gravel surfaces to impermeable for lot coverage calculations. That means that gravel driveways would now count in lot coverage calculations and would limit the size of other structures and paved areas on a site.

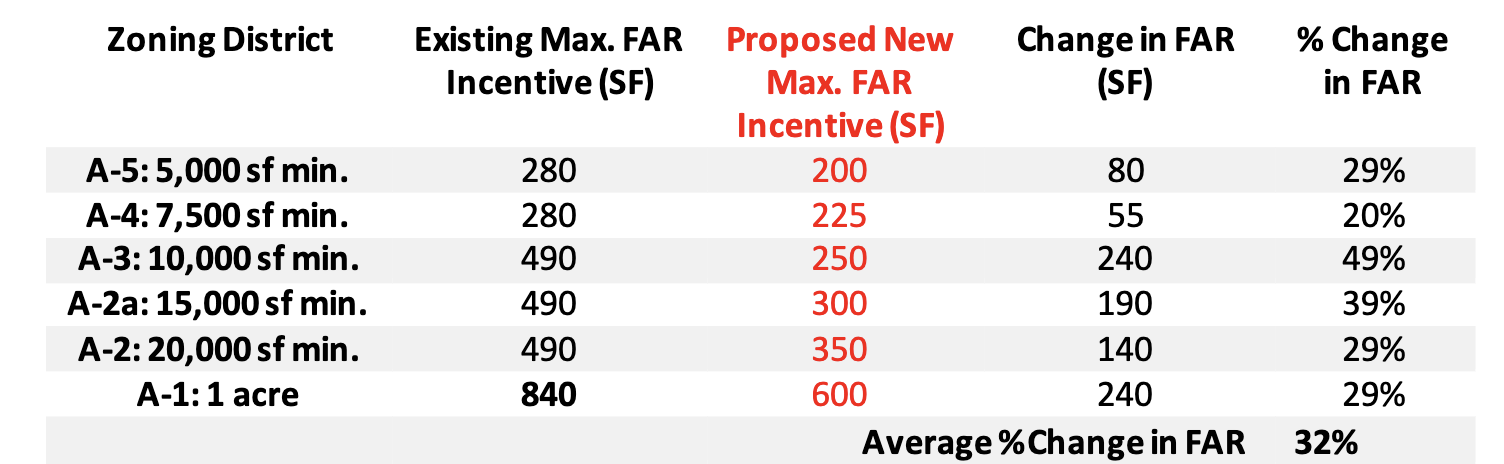

The current code offers bonuses in interior space for setting back homes beyond the required minimum. As of late, homes appear to be too large. The consultants recommended maintaining these bonuses for increased setbacks but reducing the square footage of those bonuses by zoning district.

At a prior meeting, a resident asked what the cumulative effect of changes in lot coverage, FAR, and bonuses would be. The consultants came back with this response. “We determined that the recommendations would result in an average decrease of 1.25% for FAR overall and an average decrease of 32% for the FAR side yard incentive. “

So it is yet to be seen if a 1% change in Floor Area Ratio and some decreases in bonus square footage make a noticeable impact.

Zoning District vs. Lot Size

Some of the discussion on Tuesday centered around regulations based on zoning district, vs. lot size. As all lots in a district are not uniform, some of the larger lots in one district exceed the size of those in the next, so trustees questioned whether or not it was fair to homeowners for example who might require Planning Board approval for a lot in A4, which is actually larger than a lot in A3 that would not require Planning Board review.

After much discussion, the Trustees opted to maintain these threshold numbers by zoning district.

Tree Canopy

Other changes were made due to resident comments. The provision for Planning Board review was amended to include consideration of impacts o the tree canopy. The new text says, “The location and characteristics of the different areas of vegetation, including the identification of all individual trees 6 or more inches in diameter at breast height (“DBH”), protected trees of any size, as well as stands of trees, wooded areas, and tree canopies within areas of proposed disturbance.”

Construction Management Plan

Another new provision is the addition of a construction management plan to the code. So when applicants file they will need to demonstrate how the building site and neighbors properties will be safeguarded during construction.

Impervious and Pervious

Now that gravel driveways will be considered as impervious, there was considerable discussion about the use of permeable pavers. Should they be considered pervious or impervious? Some have suggested that over time, the permeable pavers settle and the grout between them hardens into an impervious surface. Consultants recommended allowing permeable pavers to be considered as “pervious” surfaces though it was noted that they are far more expensive than gravel. And requiring their use might incentivize people to move homes closer to the street to avoid a long driveway.

Removed from the proposed code was a provision that would have allowed homes built in the flood plain to be 3 feet taller – so that they could be built above the water table. The Planning Board feared that this would encourage building in the flood plain so it was removed.

Non Conformities

There was considerable discussion about the new regulations causing existing properties to become non-conforming. For instance, if you have a one-story home that is currently set back 10 feet, and the new requirements are for a 12 foot setback, you would need a variance to build a second story on your existing house.

How big is this issue? Village Planner Kellan Cantrell said he reviewed 50 applications to the BAR and believed that only 3% of these applications would require variances under the new code.

Toward the end of the discussion Trustee Karen Brew expressed some skepticism about whether these changes would tackle the original issues that brought the Village to declare the building moratorium. She said, “There is general concern with the appearance of bulk in the A5 district (lots of .11 acres or less). She referred to the proposed regulations and said, “We are not changing a thing. The setbacks are not changed. The FAR is the same. The open space (requirement) will not make a difference. And we are still giving a FAR bonus (for additional setbacks beyond the minimums.)

The consultants responded saying, “Smaller lots are challenging. Middle size lots will be more impacted.” They added that the bonus square footage for the FAR incentive in the A5 zone would be reduced by 80 square feet.

Brew continued, “If you drive around A5 and you see what is being built, they are massive. It makes the whole neighborhood ugly. It is destroying the neighborhood. The whole idea was to decrease bulk and change stormwater management. And this is not going to help this.”

Mayor Arest asked the consultants to “look at other neighborhoods. And take another look at that.”

Penalties

Closing the work session, Mayor Arest asked the Village Attorney to look into drafting stricter penalties for those who take down homes without a Certificate of Appropriateness from the Committee for Historic Preservation. He asked, “Could they be required to rebuild the original home?:

Similarly could penalties be increased for those who clear cut properties without a permit. He wondered if the Village could require the offender to replant with similar sized trees.

Events

In other news from the Village Board, Mayor Arest reminded registered voters to vote in the primary on June 25, 2024 or to vote early, beginning Saturday June 15 at local locations. See the list of locations and voting times here.

Trustee Ken Mazer announced three events for Scarsdale seniors including a pizza party at the Scarsdale Pool on June 20 from 12-3, a Father’s Day celebration at the Girls Scout House and a Safety Expo at Scarsdale Library on Thursday June 27 at 11 am.

Trustee Gruenberg relayed that she had attended a ceremony at Wayside Cottage on Friday June 7 to commemorate slaves who resided there in the 1700’s. Witness stones were placed to remember Rose and her seven children who were slaves and residents of the cottage.

Resolutions

Trustees passed resolutions to furnish mobile radios for the Scarsdale Police Department, to purchase radio equipment for the Scarsdale Police for use in the MTA regional radio system and to purchase a Zetron Radio Console for the Police Department.

They agreed to an amendment of the CSEA Local contract to include Juneteenth. (June 19th) as a paid holiday.

They appointed Randi Culang to the Board of Architectural Review in place of current member Raul Mayta who will now serve as an alternate.

Tax Collections

Though Treasurer Ann Scaglione was not at the meeting, Mayor Arrest was pleased to report that the tax collection rate for County, School and Village taxes have all exceeded the five-year average and are all above 99%.

Village Tax Bills will be mailed out on July 1, 2024.