Sign Up Now to Participate in the Scarsdale Sidewalk Sale

- Details

- Written by Joanne Wallenstein

- Hits: 850

The Scarsdale Business Alliance (SBA) is thrilled to announce that the 2024 Summer Sidewalk Sale will take place Thursday, July 25th through Saturday, July 27th in Scarsdale Village, from 10am-6pm, rain or shine.

The Scarsdale Business Alliance (SBA) is thrilled to announce that the 2024 Summer Sidewalk Sale will take place Thursday, July 25th through Saturday, July 27th in Scarsdale Village, from 10am-6pm, rain or shine.

The SBA is now accepting applications for vendor participation. Click here to contact them. www.scarsdalebusinessalliance.com

In addition to our Village center brick and mortar store members, we welcome other SBA members to participate again this year, with designated spaces provided on Boniface Circle, which will be closed to vehicular traffic. Participation of home-based business members and members located outside of 10583 will be available by lottery.

Vendor participation and placement is on a first-come, first-serve basis. All participants must submit a Hold Harmless form and Certificate of Insurance.

For more information, visit www.scarsdalebusinessalliance.com or email info@scarsdalebusinessalliance.com.

We look forward to offering the community incredible shopping deals, delicious dining options, and fun activities, all while supporting our local retail merchants.

Zoning Code Changes: Too Little For Some, Too Much For Others

- Details

- Written by Joanne Wallenstein

- Hits: 2644

Mayor Justin Arest said it all at the close of the public hearing on May 28 about proposed building code changes in Scarsdale when he said, “More than half think it doesn’t go far enough and another think it goes too far.”

Mayor Justin Arest said it all at the close of the public hearing on May 28 about proposed building code changes in Scarsdale when he said, “More than half think it doesn’t go far enough and another think it goes too far.”

He was referring to a long list of revisions to Scarsdale’s building code, recommended by Planning Consultants BFJ. The recommendations were first presented to the public at a meeting on Tuesday May 14.

On May 28 consultants presented their recommendations again, and the public had the opportunity to comment.

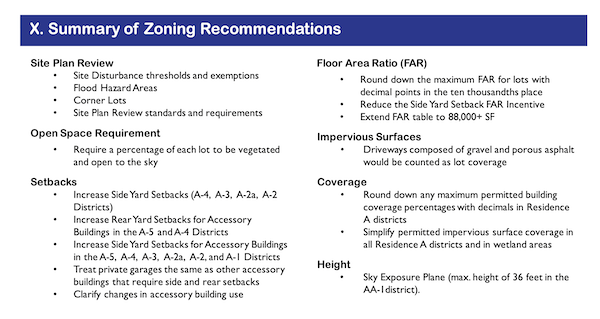

In brief, the consultants propose to use the following tools to reduce lot coverage, increase open space and improve stormwater absorption. Each alone would not have a great impact, but consultants say the combination of these factors together should have a meaningful result.

Here are the changes they are suggesting:

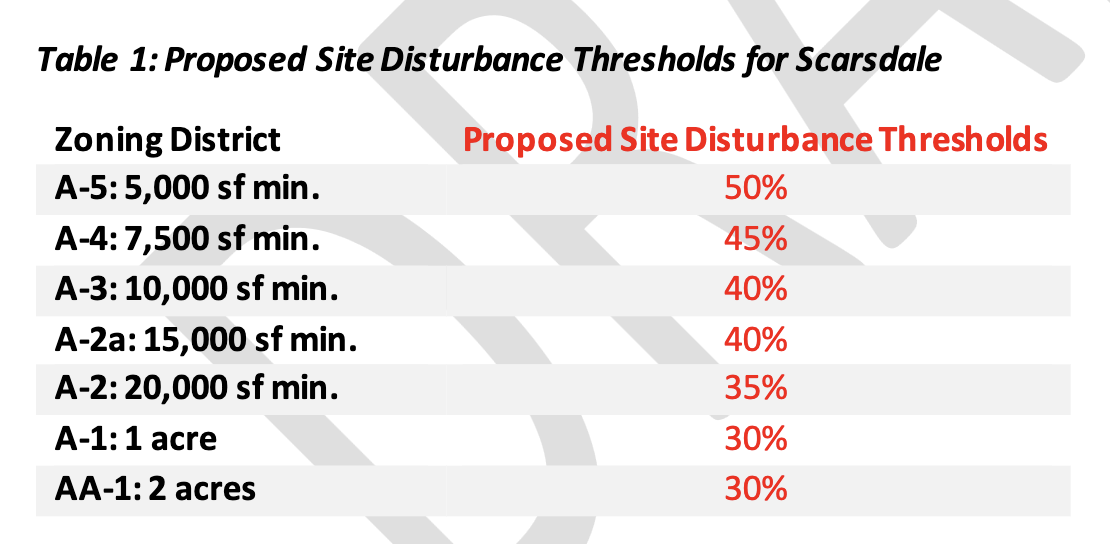

-Planning Board Review for site disturbances at defined thresholds by lot size, for building in flood hazard areas and on corner lots.

-Open space percentage requirements by zoning district.

-Slight increases in side yard setbacks for some zoning districts excluding the smallest and largest lots.

-The addition of side and rear yard setbacks for accessory buildings (like garages).

-New maximum floor area ratio (FAR) requirements as defined.

-Change in the definition of “impervious” surfaces to include gravel and asphalt, thereby reducing the amount of impervious space on a lot.

-Sky exposure plane for lots two acres or greater which would permit the maximum height to go from 32 to 36 feet provided that the front of the house is setback a minimum of 75 feet.

The consultants have received comments from the Zoning Board of Appeals and the Planning Board and those changes will be incorporated into future drafts of the proposal.

This initial proposal addressed house bulk and lot coverage, leaving aside issues of tree removals and subdivisions. So for some it did not go far enough to protect Scarsdale’s tree canopy which has seen tremendous losses in recent years. Others feared the new requirements would prevent them from adding on to existing homes and they were not clear on how they would be impacted.

Here are excerpts from some who commented:

Jordan Copeland said, “Sky exposure plane is important. Why not include this provision for other houses as well. My wish is that you can’t build a house with more than 110% of the sky exposure plane of all the other houses on the street. Taller structures right up to the setback are a concern. Expand the sky exposure plane to all neighborhoods.

Paul Diamond, a builder, asked for a clarification of “the definition of disturbance so you don’t necessarily have to go to the Planning Board” for review. He also said the new setbacks would result in non-conforming lots.

Anne Hintermeister said, “This is the board’s answer to bulk and stormwater. I think it’s an insufficient answer to either of these. I think the Planning Board agrees. Fish says “he hopes it will have an impact.” These are modest changes to existing laws. They don’t address subdivisions and replacing 2 homes with one. I don’t think we should pass a law based on what you hope. What will be the changes to runoff – how would this impact situations like Chase and Church Lane? The tree canopy is a huge issue – it is a community asset that makes us special. I don’t think we should allow the diminution of the tree canopy. Preservation of the tree canopy should be mandated. Please read the Forum report.”

Deborah Russel said, “I am disappointed that there is no acknowledgement of the cost of flooding to residents that results in street closures and downed power lines. There is no acknowledgement that its taxpayers who are paying the costs. I don’t hear anyone connecting the dots. I don’t hear them saying that what they are proposing will reduce the problem. Why are we using Mamaroneck as an example? Look hard at the cost of these problems – and show how these proposals are designed for the benefit of Scarsdale’s taxpayers.”

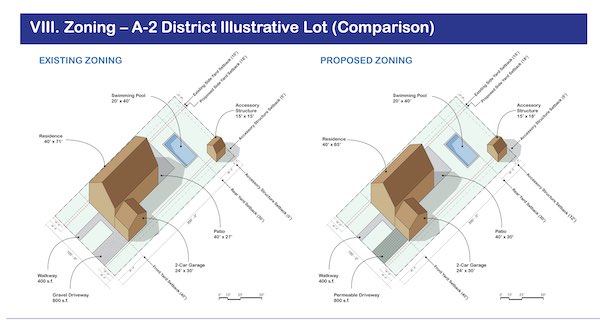

A comparison of a building plan under the new and the old code.

A comparison of a building plan under the new and the old code.

Jim Detmer said, “On the surface these proposals make sense. But it is difficult to envision how these measures would impact stormwater runoff. A minimal decrease? Is there any way to model an overbuilt lot against what would have been there (under the old laws.) Why do we need building bonuses and far incentives? We must control bulk appearance. We will inadvertently create a townhouse effect with 32 foot houses only 10 feet apart. This is leaderships opportunity to do this – let’s be bold.”

Joan Weissman said, “The proposed amendments are a step in the right direction, but they must be strengthened to have any real impact. The open space requirement is a welcome addition, but a more comprehensive explanation as to how this proposal relates to setbacks and lot coverage is necessary. In any event, in order to truly increase green space, all setbacks and the open space requirement should be increased beyond what is recommended.

The inclusion of porous asphalt and gravel in the definition of impervious surface is long overdue. But, the use of permeable pavers as a substitute is not the answer. Permeable pavers over time lose all or most of their ability to allow water to soak through unless proper maintenance is conducted so that the voids in the joints do not become clogged. This issue is raised in the NYS DEC Stormwater Management Design Manual as well as by NYC and the US Dept of Energy and Environment. There is no feasible way for the village to assure that the requisite maintenance, which may be required several times a year, is carried out. The use of permeable pavers will have the same negative consequences that are experienced with the use of gravel and porous asphalt.

The proposed requirement that the issuance of a certificate of occupancy be based on the Village Building Inspector and Engineer’s review and approval of the As of Built Survey does not address the problem it seeks to solve. By the time construction is completed, it is too late to discover that plans have not been followed. It is imperative that village staff be mandated to review measurements and calculations contained in submitted plans prior to any permit approvals and to carry out inspections throughout the construction process to confirm that approved plans are being followed.

The legislative intent and purpose of the law establishing the moratorium states that among the adverse impacts of development in Scarsdale are the “negative environmental impacts such as the destruction of mature trees and natural habitats.” We all know the crucial role trees play in providing a healthy environment. The recommended code changes do nothing to preserve our village’s trees or natural habitats. The proposed amendment that simply requires certain site plans include a description of the location of different areas of vegetation and of certain trees provides no protection for any vegetation, including trees. I urge the Board to address Scarsdale’s ongoing canopy loss as well as the loss of our natural habitats by making the necessary changes throughout the village code.”

Madelaine Eppenstein discussed the “ongoing exploitation of the Village tree canopy.” She said, “Responsible development should protect the Village tree canopy and not help to destroy it. Trees mitigate stormwater runoff. The last time the tree code was updated was 2018-19 and there were many compromises made. I suggest we go back to this code and protect our environment.”

Linda Killian said, “Most of our community was developed in the early part of the century as a railroad suburb. Our neighborhoods were put together with a lot of thought to setbacks and style – no two were alike. People are objecting to the new cookie cutter houses, that are too large. Would these proposed changes prevent subdivisions like that? On 27 Woods Lane, would these new rules prevent two out of whack, out of context houses from being built there?

Cal Petrescu who is an architect and resident said, “Wider driveways would affect the open space provisions.” Referring to the decrease in the setback bonuses he said, “Without the bonus, developers may increase the width to increase curb appeal. Buyers count on these bonuses. Losing a small bedroom is drastic. Reducing setbacks makes lots non-conforming. Houses will be non-conforming and less likely to sell.”

Barry Abramson said, “These revisions are only a small first step and don’t address the issues of our stormwater infrastructure. I don’t see how this will address our flooding. Even if every new house is in compliance, they will still be larger than the old house it replaces. No one goes smaller in Scarsdale.”

Cathy Liu who is a stormwater engineer said, “The Village has changed the code about gravel several times. I hope in the future we don’t need consultants to tell us that gravel should be considered as impervious. I am also concerned with pervious pavers. They have to be maintained.”

Elaine Weir said, “I am concerned about flooding. The land use proposal does not address this. It does not increase our flood plain which is obsolete. We need a realistic flood map and then we need to increase it to account for climate change. We need to prohibit subdivisions in flood prone areas. It poses risks to the surrounding homes. This causes neighbors costly clean ups – especially when the new house is on landfill. Spacious neighborhoods keep property values up for everyone. We need to prepare Scarsdale for the future by not overbuilding. The current proposal needs to be stronger.”

Claudine Gecel who lives on Kent Road said that a house on her street is flooding. She said, “It’s next to a subdivision and the land for the next house was clear cut.” She said referred to homes built on Fox Meadow Road and Paddington Road using cultecs to store the water. And said “they did not hold the water and a month ago the road needed to be shut down due to flooding.”

Addressing Gecel, builder Eilon Amidor said, “We have a plan to resolve the flooding.” He said, “Every decision limiting development will hurt the Village. We have to make a referendum because it’s a big decision for a lot of people with a lot of money. I am sure the people would vote no. I build in Mamaroneck They need to resolve their flooding issues. I would not use any examples from Mamaroneck. We will have a catastrophic jam at the Planning Board. You’re making problems for designers. You’re making smaller houses. I did a three-lot subdivision – people told me it will look like Queens.”

Sean Danahey said, “Everyone is speaking about changes in our designs. There are unintended consequences. Not being able to expand the house could have serious economic consequences.”

Tom Shorter said, “A lot of homes are being torn down changing village character.” He asked the board to “Protect the ability of homeowners to make changes or else these homes will be ripe picking for the contractors. I don’t see the young residents here. They will find out in a year when they want to expand and find these changes can’t be done.”

Joe Zakierski said, “The proposal is long, difficult to digest and to understand. Many are unaware this is happening. Information is harder to come by. I am concerned that the trustees have the power to sign off on this without wider community input. It is imperative to get more people educated. I like the idea of a town wide vote. Perhaps we should have separate regulations for existing homes and new builds. To make these changes you need to be sure.”

Emilie Cordell asked the consultants to visit some of the properties that are of concern.

She discussed “extraordinary noise caused by rock blasting. Saying “There is no parameters around this.” She said, “Take a look at a street. I live in Edgewood – they are maxing out the lots.”

Mayor Arest replied to Cordell saying that a noise ordinance had recently passed that regulates noise from construction.

Michelle Sterling said, “Permeable pavers are a misnomer. They are impermeable but there are gaps between them. They have to be properly installed. The gaps need to be kept clear of silt and over time those gaps fill up. It takes extensive maintenance. Pavers retain and emit heat while grass cools. Permeable pavers are not permeable.”

Miriam Petrescu said, “Look at all the homes that will become non-conforming. You need to advise the residents.”

Jon Spivak called in and said, “I have barely skimmed this document. I don’t know if this is good or bad. We have to know what this means for us and our homes.”

In comments from the trustees, Dara Gruenberg replied to Joe Zakierski. She said, “I want to address the “lack of transparency.” She said, “We created Scarsdale Official. There is also personal responsibility You need to educate yourself and spend the time. Maybe we can make it more digestible. These are complicated issues that takes time to digest.”

Karen Brew said, “We need to make enough of a difference -and I question whether these go far enough.” She asked the Village Planner to take a look back at houses that have been built and how this would affect those plans.

Ken Mazer asked for an analysis of a random sampling of past BAR applications for home additions and what the new regulations do to these applications.

Jeremy Wise said, “It is complicated. My head is spinning. I would like to see a summary…. one document that is an official document of the board.”

A second work session is planned for June 11 with a vote on the new code on Tuesday June 25, 2024.

See the proposed code and the presentation here.

Village Trustees Take a First Step Toward Offering Relief to Aggrieved Taxpayers

- Details

- Written by Joanne Wallenstein

- Hits: 1207

Will 216 residents receive refunds of tax penalties and fees they paid when they failed to receive their school tax bills in the mail? On Monday the Scarsdale Board of Trustees took a step to clear the way for the refunds but it will be months before we know if and when the monies will be returned.

Will 216 residents receive refunds of tax penalties and fees they paid when they failed to receive their school tax bills in the mail? On Monday the Scarsdale Board of Trustees took a step to clear the way for the refunds but it will be months before we know if and when the monies will be returned.

As background, in January 2024 it came to light that 216 taxpayers had missed both the first and second installments of their school tax payments, and many claimed that they never received a bill. After an investigation the Village determined that some households had not gotten their bills and put the blame on the U.S Post Office. Even though the onus is on taxpayers to pay their real estate taxes, with or without a paper bill, the Village is looking for a means to forgive and remit fees and penalties to the affected taxpayers. However it’s not so easy as the matter is regulated by NYS law.

Read the Mayor’s February 2024 statement on the issue here:

The Village reached out to State Assemblywoman Amy Paulin who coordinated with State Senator Shelley Mayer to propose resolutions in both houses to permit refunds of penalties due to the failure of the. Post office. Assemblywoman Paulin learned that the Scarsdale Board of Trustees would need to pass a “Home Rule” request to remit the funds as well. They did so at a special meeting on Monday May 6, 2024.

In order for the Village to refund the fees, the resolutions will need to pass in both the NYS Assembly and the NYS Senate before they end their sessions in June. If passed, it will then go to the Governor who will have several months to sign it.

Refunds will not be given to those who made the first payment but failed to make the second, as it’s up to the taxpayer to remember to remit the second installment. Refunds will also not be given to those who were delinquent with school, village or county taxes in 2021, 2022 or 2023.

Though the two-part payment system was intended to ease the burden on taxpayers, it has caused many more late payments resulting in fees and penalties. In February the Mayor said that since the Village adopted the two-part payment process in 2020 the average penalties overall were $1,781,876, up from an average of $496,639 for the fiscal years 2014-15 to 2019-20.

Consultants Propose Changes to Building Code to Reduce Bulk and Lot Coverage

- Details

- Written by Joanne Wallenstein

- Hits: 2673

What will be the outcome of a six-month building moratorium in Scarsdale? Will oversized homes on undersized lots be a thing of the past? How close is too close to the property line or the street for a home to be built? How much of a lot can be covered with impervious surfaces? Will treasured historic homes continue to be knocked down and replaced with two cookie cutter homes jammed onto a lot in the place of one?

What will be the outcome of a six-month building moratorium in Scarsdale? Will oversized homes on undersized lots be a thing of the past? How close is too close to the property line or the street for a home to be built? How much of a lot can be covered with impervious surfaces? Will treasured historic homes continue to be knocked down and replaced with two cookie cutter homes jammed onto a lot in the place of one?

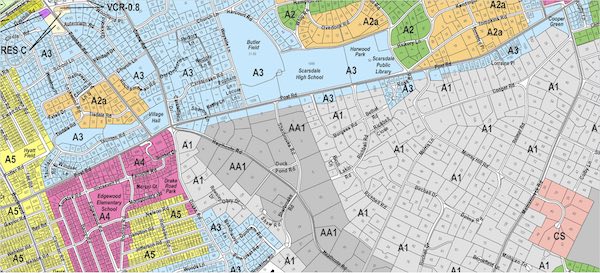

These were just some of the issues that elicited a petition from concerned residents in October 2023 and led to the establishment of a building moratorium in January 2024. During the moratorium the Village took a pause on the approval of new building applications and retained BFJ Planning to study and make recommendations on the following:

-Reduce the appearance of bulk

-Reduce stormwater runoff

-Architectural guidelines for principal dwellings

-Maximum buildout analysis

-Historic preservation of older homes

The charge was to examine these issues and “develop specific zoning code changes that effectively address the community’s concerns.”

Working with the consultants were Acting Village Manager Alexandra Marshall, Village Planner Kellan Cantrell, Village Engineer David Goessl, Building Inspector Frank Diodati, Superintendent of Public Works Jeff Coleman, and Village Attorney Nicholas Ward Willis. The Mayor and Trustees Brew and Gans also attended some meetings.

Now five months later, at a work session on Tuesday May 14, 2024, the consultants provided their recommendations to address three items on the list and suggested that two additional items, architectural guidelines and historic preservation, could be examined in a separate contract at a later date.

In order to address lot coverage and home bulk BFJ proposed a long series of changes to existing code. Though many of the proposed changes look like modest tweaks to current regulations, the cover memo from the consultants explains, “Each recommendation alone would not be drastic: however, when combined, they address the two main issues described in the moratorium: the appearance of bulk and stormwater impact.”

Listening to the presentation, it was difficult to envision the potential effects of these changes. Would they prevent some of the most egregious examples of overbuilding that led to the moratorium?

For example, for a house on 1/3 of an acre (15,000 square feet), would increasing the side yard setback by a foot on either  Neighbors fought an application to demolish 27 Woods Lane, which the buyers proposed to take down and build two homes in its place. Would the new laws prevent that?side, and taking 90 square feet off a 4,800 square foot house noticeably reduce the appearance of bulk? Without renderings, simulations and visual examples of how these new regulations would impact the design and siting of new homes it was hard to know. Perhaps the consultants can provide these visuals so that residents and builders can envision the potential impacts of the revisions.

Neighbors fought an application to demolish 27 Woods Lane, which the buyers proposed to take down and build two homes in its place. Would the new laws prevent that?side, and taking 90 square feet off a 4,800 square foot house noticeably reduce the appearance of bulk? Without renderings, simulations and visual examples of how these new regulations would impact the design and siting of new homes it was hard to know. Perhaps the consultants can provide these visuals so that residents and builders can envision the potential impacts of the revisions.

The report also suggested far reaching changes in the application process, shifting some decisions from the Board of Architectural Review to the Planning Board, and requiring variances for work on non-conforming lots which would be provided by the Zoning Board of Appeals. From the presentation, it was difficult to understand the new approval process; which board would see the application first and how an application would proceed. More work is needed to clarify these points, as in the past, applicants have exploited gaps in procedure to get around Village Code.

Here are highlights of the proposal. Review the entire document here:

Role of the Planning Board

The code change would increase the role of the Planning Board. All applications for building within flood hazard areas would need to get the approval of the Planning Board.

Planning Board review would also be required for any development that impacts the adjoining property buffer. How much disturbance would trigger the need for Planning Board approval? A graduated chart of the thresholds of the percentage of the site that is disturbed for each zoning district is included. Would the Planning Board have the authority to deny an application based on issues with site disturbance?

As the Village currently has no regulations for potential flooding during construction, developers building in flood zones would need to provide and get approval for a Construction Management Plan to show how they are going to protect neighbors from excess water and soil runoff during the building process.

Homes on corner lots, which often appear to be too bulky would also need to be reviewed by the Planning Board due to “their unique sight lines and high visibility.” A new home on a corner lot on Carthage Road

A new home on a corner lot on Carthage Road

Open Space Requirement

Another new requirement would be to set requirements for the amount of open space on each lot size. The proposal defines open space as “unoccupied by any structure, building, parking, paving, or other surfaces deemed to be impervious, and which is vegetated and open to the sky, either it is natural unimproved state or landscaped with lawn, trees and other plants, natural rock outcropping, natural water features or wetlands.” The effect should be to limit the coverage of the home, patio, driveway and accessory buildings and preserve green space.

Side Yard setbacks

The consultants propose modest increase in side yard setbacks for most lot sizes. For instance, for 1/4 acre lots, the side yard setback is now 10 feet. The new requirement would be 12 feet. Setbacks for accessory buildings like garages would also be required.

Floor Area Ratio

The proposal includes a small change to the Floor Area Ratio calculation by rounding off the decimal in the formula to the nearest 100th.. place. The change in total FAR permitted is negligible.

Builder’s Bonus

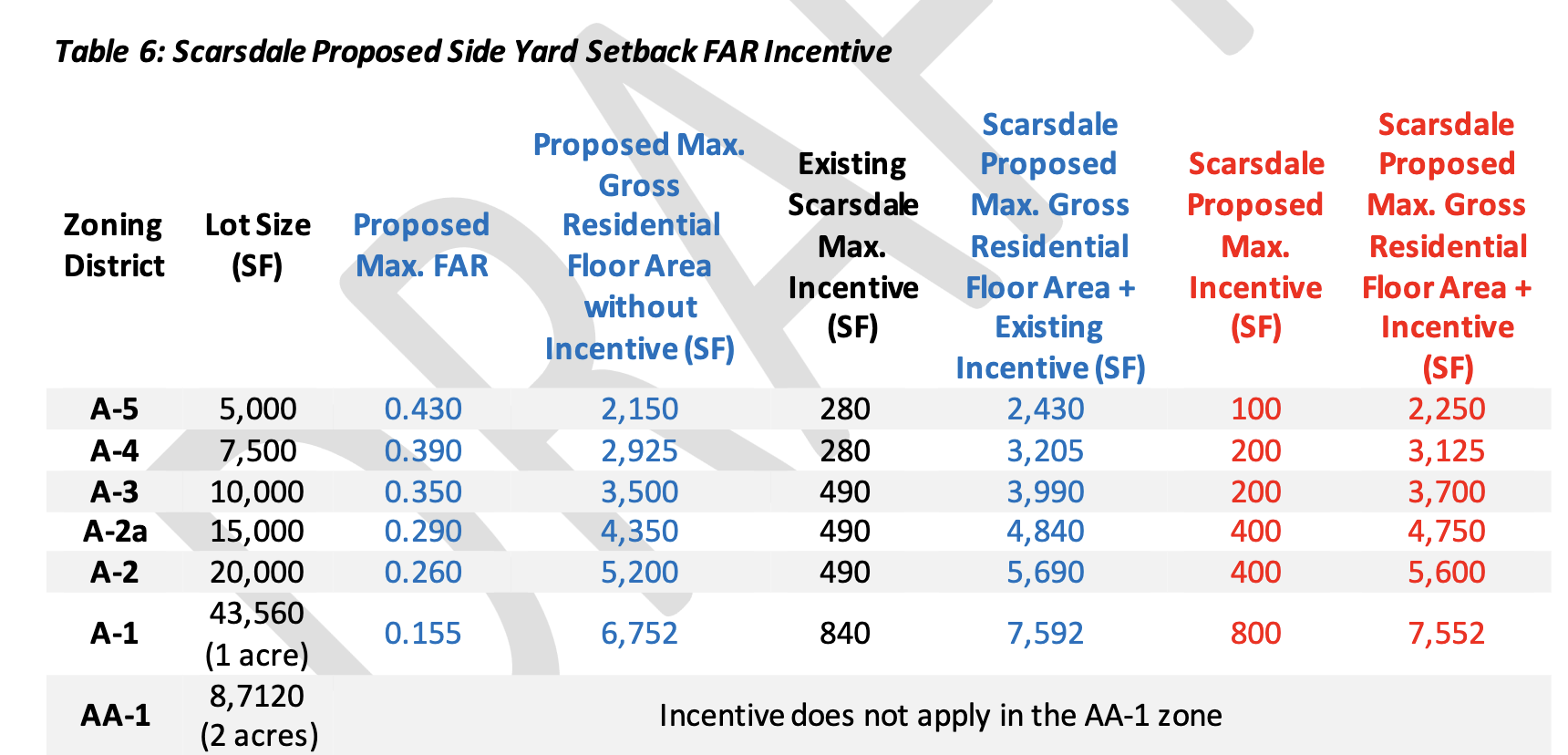

Current building code grants bonus square footage of 100 square feet of floor space for each foot that a house is set back beyond the minimum side yard set back in all zones except those in AA-1 – which are lots of 2 acres and above. Currently, there is a maximum bonus of 280 feet for zones A4 (.17 acres) and A5 (.11 acres), and a maximum of 490 square feet for lots in A2 (half acre) A-2a (1/3 acre) and A3 (1/4 acre) and 840 square feet for homes in A1 on one acre lots.

The consultants recommend small reductions in the bonus as show in the chart below. No one discussed the possibility of eliminating the bonuses all together.

Impervious Surfaces

In order to safeguard open space to reduce flooding, building code defines how much of a lot can be impervious, meaning covered by a building, a driveway, a patio etc. Currently gravel and porous asphalt is considered “pervious” and thus allows more lot coverage. The consultants recommend changing these definitions so that gravel and porous asphalt are considered impervious and counted in the lot coverage formula. They also propose allowing the use of “permeable pavers,” instead of gravel or asphalt.

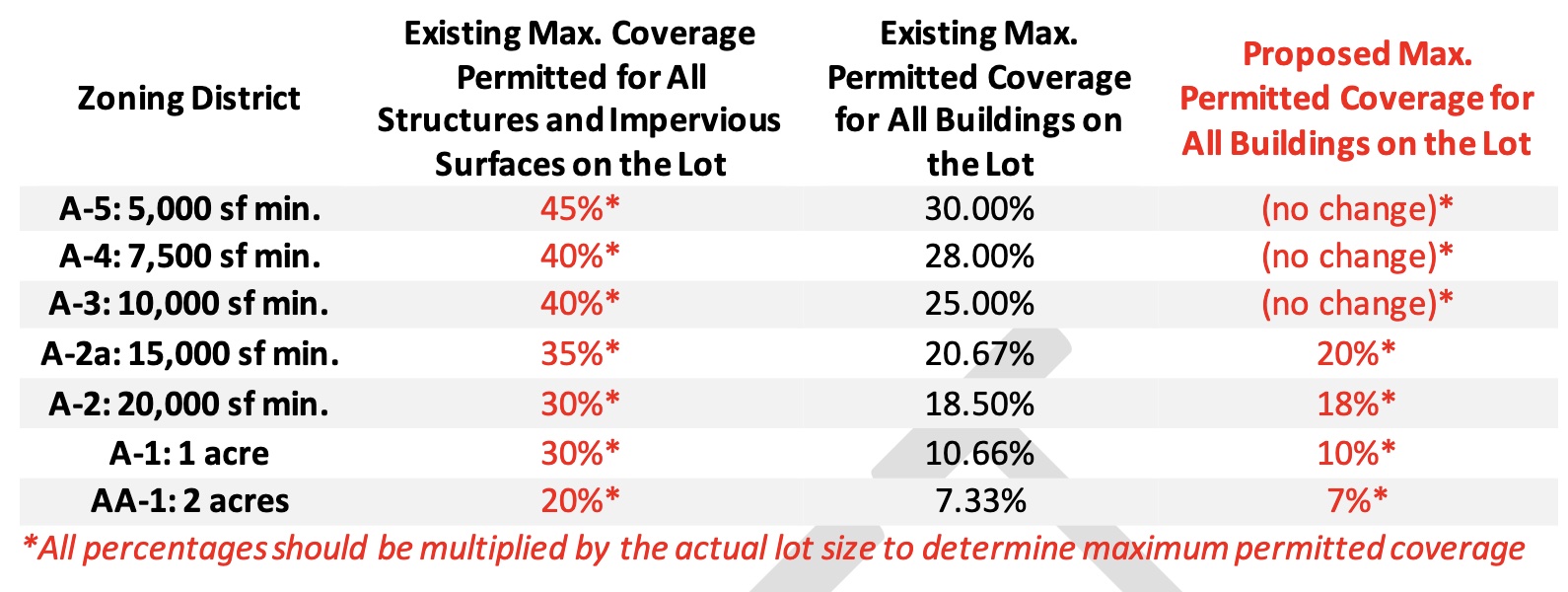

Lot Coverage

The proposal includes reductions in the permissible lot coverage on lots 1/3 acre and greater. See the chart here:

Height of Homes on Lots 2 Acres or Greater

The proposal includes a “sky incentive” to permit those building on 2 acres or more to increase their setbacks and be permitted to increase the height of the roof from 32 feet to 36 feet in order to create pitched roofs in proportion to the home.

Height of Homes in Flood Hazard Areas

The consultants suggest permitting homes built in flood hazard areas to be permitted 3 feet more in roof height (35 feet). This was suggested so that the entire home could be raised out of the flood plain. However, currently Scarsdale discourages any building in flooded areas so it was not clear why this proposal was drafted.

Escrow

Under the proposed code change, the Village could require applicants to escrow funds to reimburse the Village for fees for the professional review of applications or a SEQRA review. The Village would not issue a certificate of occupancy unless all professional review fees charges had been paid.

What’s Next?

Once the trustees approve the proposed changes the proposed code would be referred to the Westchester County Planning Board and the Scarsdale Planning Board for review, a report and a recommendation. A SEQRA review of the draft law would also be required.

In the discussion that followed the presentation, trustees noted the increased role of the Planning Board and questioned whether more training would be needed, if the size of the Planning Board would need to be increased, if they would need to meet more frequently and if more members would need to be added to the board.

Also discussed was the fact that the consultants had delineated building requirements by zoning district rather than lot size. Since there are variations in lot sizes in districts, in some cases this would permit more rather than less coverage and home size.

Discussing non-conforming lots which would result from the new code, the question was posed, “If the setbacks changed, would you be permitted to build a second story over the first with the original setback?” The answer was that the resident would need a variance from the Zoning Board of Appeals.

The Mayor noted that the code proposal did not address historic preservation, as there was not enough time during the six month moratorium to address the preservation laws as well as the building code. Since many of the building issues are a result of home demolitions, problems may still occur.

The code changes also did not address subdivisions and tree removals or the recommendations of the Scarsdale Forum which some hoped would be included in the proposal. Front yard setbacks were not addressed either. Often an older home, which is set back from the street at a gracious distance is replaced with one that looms over the sidewalk. These were many of the issues that brought dismayed residents to Village Hall in the first place.

The Village Board plans to hold two work sessions on the proposed code changes on May 28 and June 11, 2024. The current moratorium expires on July 19, 2024. If the changes are approved by the Westchester County Planning Board and the Scarsdale Planning Board and get SEQRA approval the new code would go into effect in January 2025. Until that time, the current code remains in place.

It will be interesting to see if all of the questions can be resolved in just eight weeks.

John Clapp who Chairs the Scarsdale Planning Board provided comments to the Village Board on the code proposal.

Summarizing the Planning Board memo, they support the following:

-Site plan review for land disturbances

-Increases in minimum side yard setbacks

-Reclassification of porous asphalt and gravel as impervious

They had concerns about permitting height increase in the FEMA floodplain as they do not support any development in the floodplain.

They said further work needs to be done on the lot coverage and building formulas.

They said they did not think the open space requirement would have much impact due to the lot coverage requirements and that they height increase for 2 acre lots would apply to very few properties. Residents have been advocating to save this 200 year old tree. An applicant wants to build a driveway in front of the house which would compromise the tree's roots.About site plan review for FEMA floodplain and corner lots, accessory building and FAR amendments they are “neutral” or have “no opinion.”

Residents have been advocating to save this 200 year old tree. An applicant wants to build a driveway in front of the house which would compromise the tree's roots.About site plan review for FEMA floodplain and corner lots, accessory building and FAR amendments they are “neutral” or have “no opinion.”

Given the short time frame for enacting the new code, they recommended the assignment of a “drafting committee” to “accurately implement the recommendations, harmonize them with Village code and identify and address unintended consequences.”

Madelaine Eppenstein, President of Friends of the Scarsdale Parks and a a member of the Board of the Scarsdale Forum, sent us this comment about the proposal. "Many if not all land use issues discussed at the Village Board’s work session on May 14, from impervious surfaces to grading with fill, to zoning and bulk have an intimate, existential connection to the ongoing exploitation of Scarsdale’s tree canopy. Responsible development and adequate code provisions should be protecting the Village tree canopy, not helping to destroy it, despite the well-known services trees provide to mitigate flooding, stormwater runoff, sequester carbon dioxide in the air we breathe, and others. Scarsdale Forum’s February report on these issues sets forth specific recommendations for code amendments and a request for a meeting of stakeholders, which, regrettably, has yet to be acknowledged or scheduled by the Village Board."

Village Board Passes Budget and Issues Warnings on Water Meters and Signs

- Details

- Written by Joanne Wallenstein

- Hits: 2285

The Village Board wore denim to the 4-30 meeting in recognition of Denim Day.The Village Board voted unanimously to approve the budget for fiscal year 2024-25 at their April 30, 2024 meeting. The budget calls for a tax levy of $48,803,000 which is a 4.93% increase over last year and will translate to an increase of $348.39 for the average household in Scarsdale.

The Village Board wore denim to the 4-30 meeting in recognition of Denim Day.The Village Board voted unanimously to approve the budget for fiscal year 2024-25 at their April 30, 2024 meeting. The budget calls for a tax levy of $48,803,000 which is a 4.93% increase over last year and will translate to an increase of $348.39 for the average household in Scarsdale.

The increase exceeds the NYS Tax Cap which allows for an increase of the levy by the lesser of 2% or the rate of inflation. Given the Village’s non-discretionary costs, such as insurance premiums and pension costs, staying within the tax cap would require a decrease in Village services and the quality of the infrastructure. Therefore, the board agreed that the increase was necessary. See more on what is included in the Village budget here:

Trustees all supported the budget and felt the increase over the tax cap was necessary.

Karen Brew said, “it is important to strike a balance on a budget. We spent a long time hearing from department heads and the list of needs is far more that we could undertake at this time. But we know that these things are coming down the pike. We are investing in the community while striking a balance. I fully support this budget.”

Jeremy Gans agreed, saying, “I think we have done a good job of meeting the expectations of our community. I think the expenditures are necessary, and in some cases overdue, and I hope the community appreciates that.”

Sameer Ahuja said, “I plan to vote yes on the budget. There was a lot of great work by the Village staff and some great debate about how our funds should be invested.”

Jeremy Wise said, “I am new to the board and I am exceptionally impressed by the Village staff and the members of the Village Board – everyone gave it a considerable amount of thought.”

Dara Gruenberg said, “….The Village Board has worked extensively over the course of the last six months to ensure that we deliver a Village budget that balances the needs and wants of the community while also ensuring that we are being fiscally responsible and investing for the future. I feel confident that we have done just that.

This budget includes significant investment in stormwater infrastructure, monies for our parks and recreation facilities as well as renovations and updates to this building, which if you have spent time in this building, you know is in need of attention.

Exceeding the tax cap is a consequential decision for the board, but as many have noted, in prior meetings, the increase from FY 2023-24 in non-discretionary budget items exceeds the allowable levy increase under the tax cap formula before we even consider other areas that need attention for the well-being of the village.

Between the third and fourth pass of the budget, the board made a conscious decision to decrease the amount of fund balance that would have offset an increase in the tax levy. We did this because the philosophy of this board is that we should use fund balance for one-time expenses and not for operating costs. As we have unfortunately seen in some surrounding communities, using one-time monies to fund operating expenses is not only unsustainable but ultimately can lead to the major budgetary issues that are to the detriment of the residents and the welfare of the community. I understand that some do not agree with this approach, and I of course respect those opinions. However, I feel we, as a board, have acted in a manner that is fiscally prudent and balances the needs of all current and future stakeholders in Scarsdale.”

Justin Arest said "Work on this budget started over six months ago and developing a budgetary document like this which has to deal with myriad competing demands so much time in advance is never an easy task. The goal, however is always simple: to create the most responsible fiscal roadmap for our community that takes into account the needs and desires of our residents and tries to effectively provide as much as it can in the most efficient manner possible. There are always tradeoffs, and, there are always deferrals. Much work has taken place in recent history to address a potential overuse of deferrals and to work with the community to determine what is the correct level of programs, services, and infrastructure offerings and improvements that can be provided responsibly. More work will continue on this but I am proud of the improvements to the process and the overall fiscal management and oversight that has taken place and I must thank our Acting Manager, our Treasurer, their teams, and so many more on staff that have made these changes possible.

This will be the highest tax increase I will have voted on since my time on the Village Board. I nor any of my colleagues take that lightly. But we also recognize the inflationary environment we have been living in and hope that the worst of its impacts are behind us.

I want to begin to finish my budget comments specifically on the NY state tax cap. I and I believe all of my colleagues are generally supportive of the concept of a tax cap. While it is not really a cap, having an additional burden to approve a budget over a certain threshold increase is something that makes sense. Where I hope the state can look at the tax cap formula again relates to the inflationary factor. The increase includes inflation but only at the lesser of CPI or 2%. When the cap was created and for many years after, we were in or near a zero interest rate environment. In order to reflect the practical impact of the cap when inflationary pressures are much higher than that 2% limit, and potentially strengthen the tax cap's impact, revisions to the formula should be discussed.

I appreciate Trustee Wise’s comments as a newcomer as I have always felt that while I may not have always agreed with colleagues on the Board over the years, I do believe we have always worked hard and professionally with staff to find the best budgets for our community and always strived to deliver what is needed and expected with the lowest tax increase possible.

Finally, I have tried over the years to share information with residents in different ways to best explain the impact of budgetary changes. We can discuss the increase to the tax rate, the increase to the tax levy, the increase to the budget, I could go on. There is also the impact that these increases have on your total tax bill. Village taxes account for approximately 20% of your total tax bill. So, tonight I am just going to use actual tax numbers for residents in dollars based on the average household. Using market value, not assessed value, the average household is currently about $2.1mm.

The average household in Scarsdale currently pays $8,161.53. The tax cap formula would allow an increase of $231.64. The Treasurer provided the Board with helpful information early in the process that illustrated how just the obligatory increases in pension costs and health and property insurance alone would require an increase of $254.49. So, those non discretionary increases alone already amount to an increase that is about $20 higher than the tax cap threshold. What we have put forward- and I believe will approve- will lead to an increase of $348.39 (total village tax will become $8,509.92) and I am very proud of what we have been able to do in terms of continuing our high level of services and making badly needed improvements to some of our assets and infrastructure."

Renovations at Village Hall

The Board also agreed to an amendment to use $800,000 from the fund balance to finance long overdue renovations to Village Hall. Explaining the decision, Mayor Arest said, “For years there have been proposals to make improvements to Village Hall for efficiency and the comfort of the staff. They have been repeatedly deferred. There is no question that the building needs a massive renovation – or needs to be replaced. We are not going to solve that tonight. Anything will take a minimum of five to six years. This is something for the short term. It will cost about $800,000 to make the improvements in Village Hall. This will come out of the fund balance and is a one-time cost as a stop gap until we know what we are doing with the building. For right now the fund balance is at 21.76% which is above the 15% - 20 % range – if we allocate $800,000 to this project it would bring us to 20.63%.”

Water Meters

The Village has retained an outside contractor to swap outdated water meters but has had poor compliance from residents. Both the Scarsdale Water Department and National Metering Services have sent letters to approximately 1,000 properties that still have the old meters. The new meters allow for online readings of water usage and are more efficient.

In order to get more residents to participate those who do not comply will get a $500 fee on their water bill. If the meter is changed within 60 days, the fee will be waived. If you’re not sure whether or not you need a new meter, call the water department at 914-722-1138.

Lawn Signs

Mayor Arest warned residents not to place lawn signs in the Village right of way. He said, “You are allowed to place lawn signs on your lawn and your property, but not in the Village right of way.” He explained that as a rule, the Village right of way is the space “approximately 13 feet in from the curb.” He said, “Please express yourself on your own property.”

Pickleball

Steve Marciano from 104 Walworth Avenue spoke during public comments and applauded the new pickleball courts at Crossway. However he said, “For the last two years we played pickleball at Brite Avenue. We are dismayed to learn that the Brite Avenue courts are no longer available for pickleball. We are just a few of the Greenacres and Fox Meadow residents who have enjoyed these courts and ask the Village to allow us to continue to play there. If there are neighbor objections – allow it no earlier than 9 am and no later than 6 pm. If we can allow gardeners to work this should be permitted too. Please add the Brite Avenue courts back onto the reservation system.”

Mayor Arest responded saying, “The board tries to make as many people as possible happy – but we are never going to make everyone happy. The Crossway tennis courts need work – and this is a way to make use of the tennis courts before the work is done. At Crossway, the courts are twice as far away from homes as they are at Brite Avenue. And the tennis courts are more appropriate for pickleball. The paddle courts (at Brite Avenue) will not hold AcoustiFence. We don’t think there is a lack of courts based on demand – though we are monitoring usage. For now the courts at Crossway will be the only pickleball courts.”

Public Comments

Bob Harrison asked why the Village Board meeting minutes did include the public comments. He said the minutes were not complete. He also said that written communications to the Village Board are no longer appearing in the agenda. He asked how these communications should be sent. The Mayor said the minutes are intended to be a summary. He encouraged people to go online and watch the meetings. He also said that residents who wish to write to the Board should send them to publiccomments@scarsdale.com.

Denim Day

The manager and Mayor discussed the importance of Denim Day, which this year was on April 17, 2024. The Village Board all wore denim to the meeting to highlight the need to prevent and condemn sexual violence and the Mayor read a portion of the Denim Day proclamation.

Farmers Market

Acting Village Manager Alex Marshall announced the Grand Opening of the Scarsdale Farmers Market on Mother’s Day, Sunday May 12 from 9 am to 2 pm. The market will run from May 12, 2024 to November 24, 2024 and bring local goods from regional farmers to the Village. The market will be hosted by Down to Earth Markets and you can see a vendor list here.